“Looking forward, we cannot say exactly when the qualities of the businesses we own will become evident in their share prices; what we can say is that we have used the same approach for more than 20 years and it has served our clients well. There have been weaker periods of performance as a consequence of value rallies – notably in 2003, 2009 and 2016 – but by sticking to our process, we have more than compensated for these over the last 21 years and are confident that backing sustainable businesses is the path to making good recent underperformance once again.”

Peter Michaelis, commenting on prospects for the Liontrust Sustainable Future funds after a spell of underperformance since September last year.

What has changed in terms of the macro and market backdrop this year?

We have seen a significant change in approach from many central banks, moving more hawkish on interest rates as they look to bring inflation under control. Significantly higher inflation is a consequence of the loose monetary policies designed to boost economies after Covid lockdowns, as well as supply issues caused by the latter, and the war in Ukraine has exacerbated some of these economic maladies.

Given this backdrop, there is growing talk of potential recession and slowing global growth: in the UK, for example, OECD figures suggest GDP is expected to stagnate in 2023 amid persistent supply chain shortages and inflation, with only Russia in worse shape in the G20.

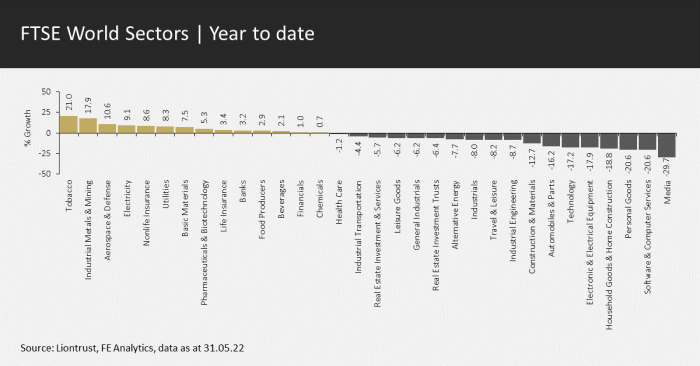

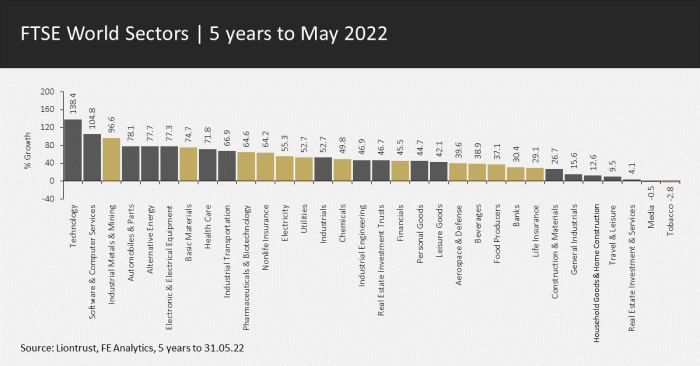

We are therefore in an extremely challenging period for markets, with the vast majority of asset classes struggling. On the equity front, amid a wide sell-off, value has outperformed growth and quality as a style. If we look at the FTSE World Index, sectors that have benefited from this relatively better value performance over recent months are tobacco, defence and energy, while growth areas have struggled. All these outperformers are parts of the market where our Sustainable Future (SF) funds have never invested.

Needless to say, these are short-term phenomena and, as the next chart shows, performance looks very different over five years, where quality and growth have significantly outperformed value overall and technology has far outstripped those lagging value sectors.

How has this impacted our Sustainable Future funds?

Since we launched the SF funds in 2001, our proposition to clients has been to deliver superior returns by investing in sustainable companies whose products and services help make our world cleaner, healthier and safer. This focuses our funds on businesses we believe will see profitability grow strongly over the coming years.

Generally, our strategies have made good on this ambition, outperforming the average of our peers and conventional benchmarks over five, 10, 15 and 20 years where relevant. More recently, however, the picture is one of marked underperformance, a trend that began in September last year. The trigger for this change has been this backdrop of higher inflation and rising interest rates, which has led to share price falls in the growth stocks that comprise the bulk of our portfolios.

For companies where the market expects growth for years to come, a large proportion of the valuation is attributed to cash flows in the future (known as long duration); conversely, for stocks with lower expectations, less value is ascribed to future growth and the bulk of the value is in near-term cash flows. Companies with strong growth expectations, therefore, have higher sensitivity to interest rate changes than those with lower growth prospects, with the market discounting future earnings more heavily and bringing down their present value as a result.

This shift has hit our funds hard given their growth bias and longer duration relative to the market. Our funds have fallen more than benchmarks but, to reiterate, these indices contain many currently outperforming ‘value’ companies in oil, tobacco and defence sectors, where we have never invested.

We also believe sell-offs in markets have not discriminated between companies that are significantly affected by this changed environment and those whose prospects remain strong. Our focus is on finding businesses that will deliver strong returns on a five-year view and longer and we have conviction that trends towards resource efficiency, innovation in healthcare and cyber security, for example, are intact. Just as importantly, we believe that, longer term, the strong growth our companies exhibit will more than compensate for any change in the discount rate.

With growth companies penalised in the current environment, we have seen a rush into lower valuation, lower duration parts of the market, including cyclical, commodity and energy stocks. But is it important to remember why interest rates have increased: to try to control runaway inflation.

Inflation increases input costs for companies and squeezes profit margins, and management teams have a few options to protect margins: either offsetting higher costs with efficiencies or, more likely, passing increases on to customers. For this to work, however, you have to invest in companies with pricing power and again, given the scarcity of truly high-quality businesses, these tend to have higher valuations and thus higher duration.

Therefore, a counterintuitive situation has occurred where the prospect of higher inflation has negatively impacted exactly the sort of companies best placed to cope with it. In contrast, lower-quality companies without pricing power or strong profit margins, which are likely to suffer over the long term from higher inflation, have become popular in this rotation. It strikes us as an odd short-term move.

Have there been any other factors behind recent weaker performance?

A further factor has been the aggressive sell-off in many so-called Covid darling stocks, which did particularly well during lockdowns. Companies such as Netflix and Zoom have seen their share prices plummet over recent months and some of our holdings have been caught up in that trend, in addition to being growth businesses.

One example is Oxford BioMedica, which creates new treatments using gene therapies, hugely widening the scope in terms of helping people suffering from previously untreatable diseases; in addition, the company manufactured millions of doses of the Oxford-AZ Covid vaccine and its share price rose rapidly as a result. Over the last six months, the shares have sold off dramatically but if you compare the business to how it looked in 2019, it is vastly different, with revenues three times higher and moving from a handful of partners to more than a dozen major pharmaceutical names looking to buy its products.

We see its prospects as so much better and yet, after the sell-off, the shares are back to where they were three years ago; we continue to have great conviction in the company delivering over the longer term.

Another affected name is US-listed DocuSign, which saw a huge acceleration in terms of demand as it enables paperless contract signing and businesses needed its services to operate in a lockdown world. We are still only in the earliest stages of market penetration in terms of paperless signatures and DocuSign is the clear market leader. It is now four times the size it was pre-pandemic and, yet again, the share price is back to where it was before Covid after recent selling. We see the company as a major beneficiary of the move towards a more circular economy and greater resource efficiency, saving billions of sheets of paper (and therefore trees) based on its position today and potentially increasing this massively as the market continues to grow.

Should changing conditions enforce a change in the Sustainable Future investment process?

In the face of a more challenging backdrop for our SF investment process, it is worth reiterating exactly what we mean by a sustainable company and why we continue to believe there is alignment between doing good things and business success.

If you examine how change happens, there tend to be three actors at work: first, an understanding is developed of the issue and likely ways to resolve it is discovered (air pollution is harmful to health, for example), then society/government lay the groundwork for action – via new regulations, taxes and other incentives – and finally companies take advantage of the opportunity to develop, commercialise and distribute solutions. This moves the dial of the possible and accelerates the process.

What is interesting from an investment point of view is that the businesses involved in this triangle tend to experience strong and persistent demand growth and face less competition due to the novelty of the product or service they are delivering.

Given the recent shift in inflation and interest rates and strong value rotation, we asked ourselves two questions:

- Should we change our portfolios to invest in more value-like names?

- Is the growth outlook for businesses in which we invest weakened, and do they still offer potentially good long-term share price rewards?

The answer to the first is an emphatic no. We have used the same approach for more than 20 years and it has served our clients well. The second question is one we concern ourselves with every day in the analysis of the companies in our funds and we are still broadly comfortable the businesses in which we invest will deliver strong growth and share price performance over the long term.

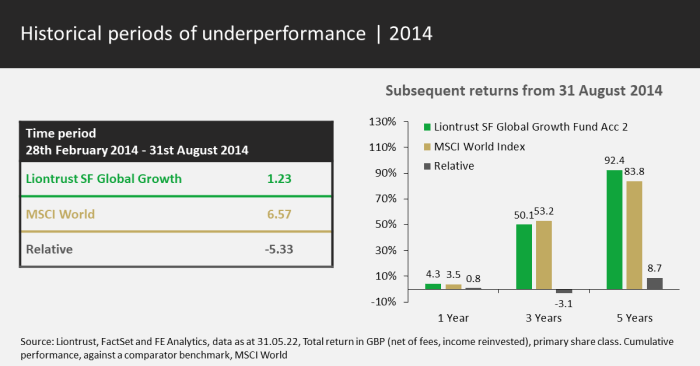

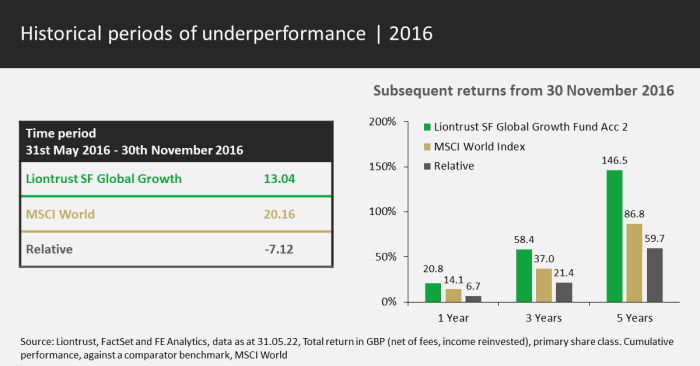

To illustrate how this has worked in the past, the following pair of charts highlight previous periods of underperformance from our SF Global Growth Fund, driven by value rallies in 2014 and 2016, showing how we have gone on to generate strong subsequent returns.

Going back to our investment process, we focus on four stages in our analysis of companies: theme, overall sustainability, fundamentals and valuation. Our 20 sustainable investment themes look to harness societal and environmental necessity, identifying companies meeting unmet needs. This typically involves backing innovators: firms tackling challenges by investing in Research and Development, products and customer services, protecting and growing their return on capital, and proactively managing environmental, social and governance (ESG) impacts.

This is why we remain confident despite fears around slowing growth and continue to focus on our core competence: identifying businesses exposed to sustainability trends that will endure and grow their value, for the most part, independent of the economic backdrop. Nevertheless, we acknowledge that, during periods of stress, time horizons typically shorten; it is therefore crucial for us to retain our focus on the long term – and we are acutely aware this would be impossible without our clients continuing to support us in doing so.

How could the situation in Ukraine affect the energy transition?

We continue to believe human ingenuity, co-operation and desire to improve our lives leads to solutions and that profit-making companies backed by capital from investment managers have a big part to play. It is reasonable, though, to ask whether this model will work for such enormous challenges as climate change, biodiversity collapse or increasing inequality.

On climate change, for example, we have been aware of the issue for over 30 years, and yet the latest IPCC (Intergovernmental Panel on Climate Change) report, issued in February 2022, shows greenhouse gases at record levels and that we are already experiencing some of the predicted extreme weather-related impacts.

With more than 80% of global energy still coming from fossil fuels, is this not a challenge too far? We believe not. Change is rarely linear and when a cheaper, better solution is developed, it can displace the old at an exponential rate. Progress has been slow but we are confident the rapid growth in renewables and adoption of electric vehicles are examples of these exponential transitions.

For years, renewables plodded along supported by regulation and subsidies, then there was a tipping point where, in region after region, it became the cheapest form of new energy generation. Since 2010, solar has fallen by 90% in price and onshore wind by 60% – and this cost deflation continues. The consequence of such growth is the picking off of fossil fuel generation, starting with coal. Since 2008, regardless of the US president in power, coal power has fallen by 61%.

We are often asked whether we invest in turnaround situations, such as oil companies pivoting to renewables, for example. This sounds like a potentially attractive strategy but we avoid it for two reasons – first, it is rare for companies to successfully execute such a pivot (think Kodak and the digital camera, or Nokia and the smartphone) and second, we like to stick to a strategy we know well and that has demonstrated long-term success. We therefore continue with our thematic approach to select winners and avoid those losing due to inevitable change.

Looking at the situation in Ukraine, as would be expected, we have zero exposure to the types of companies that should benefit directly from higher energy and commodity prices, such as miners and fossil fuel extraction. We do, however, believe that higher energy and commodity prices should increase the willingness of governments and businesses to invest in renewable energy and focus more on improving their efficiency of energy use. The current situation in Europe reinforces the case for both the greater supply security that renewables can offer and reducing reliance on many of the major oil-producing countries.

This would be a major benefit to the world, making it more likely that climate goals are achieved, but it also has potential implications for our portfolios. As it stands today, around a third of our SF funds are invested in companies whose products and services are designed to make the use of resources more efficient. The majority of these are held under our Improving the efficiency of energy use and Improving the resource efficiency of industrial and agricultural processes themes, and we expect demand for their produce to increase from here.

Has the recent sell-off created opportunities for the SF funds?

We have recently reviewed each of our holdings to ensure that, in this new higher interest rate and inflation world, our conviction remains strong. And, in almost all cases, it does. We have therefore not altered our portfolios significantly; this may sound as if we are not managing the assets actively but it has never been our approach to trade our portfolios rapidly, only when necessary.

Experience has also shown that indiscriminate sell-offs provide opportunities to add to our highest-conviction companies at more attractive valuations, as well as starting positions in names we have long admired but, prior to now, were fairly valued by the market. In our global portfolios, for example, an addition over Q1 was Masimo, under our Enabling innovation in healthcare theme. Headquartered in the US, Masimo’s core product is pulse oximetry sensors, which enable a patient’s vital signs to be monitored. The company places circuit boards (referred to as drivers) into bedside monitor machines and then sells the hospital sensors to pair with these devices.

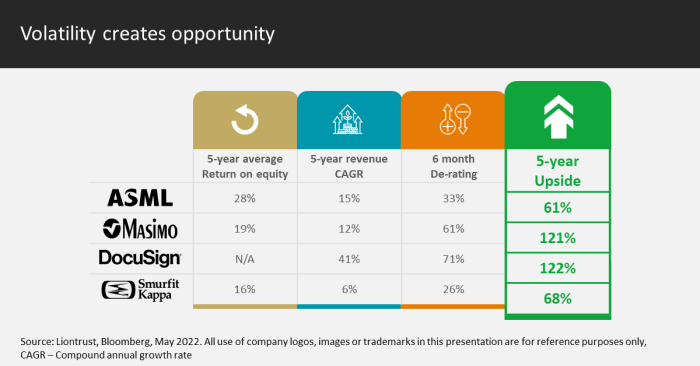

Based on our fundamental analysis (shown above), the company has a five-year average return on equity of 19% and a five-year revenue compound annual growth rate of 12%; most significantly, with the shares having derated by around 60% over the last six months, we see upside in the region of 120% over the next five years.

Another recent additional in our UK portfolios is Ashtead under our Delivering a circular materials economy theme. This is the embodiment of a sharing economy, renting out industrial, commercial and general equipment across the US, UK and Canada. The company maximises the use of equipment that would otherwise sit idle for long periods and offers assurance this kit is serviced and maintained properly.

In doing so, Ashtead allows the businesses that rent its equipment to concentrate on their core competencies as well as reducing their own inventories. Ashtead is a rare example of a UK success story in the US, acquiring Sunbelt in 1990, then adding the US rental business of Rentokil in 2000 and NationsRent in 2006. This has led to sales going from £47 million in 1990 to £7 billion now and, the financial crisis aside, returns on equity consistently above 20%.

Looking forward, we cannot say exactly when the qualities of the businesses we own will become evident in their share prices; what we can say is that we have used the same approach for more than 20 years and it has served our clients well. There have been weaker periods of performance as a consequence of value rallies – notably in 2003, 2009 and 2016 – but by sticking to our process, we have more than compensated for these over the last 21 years and are confident that backing sustainable businesses is the path to making good recent underperformance once again.

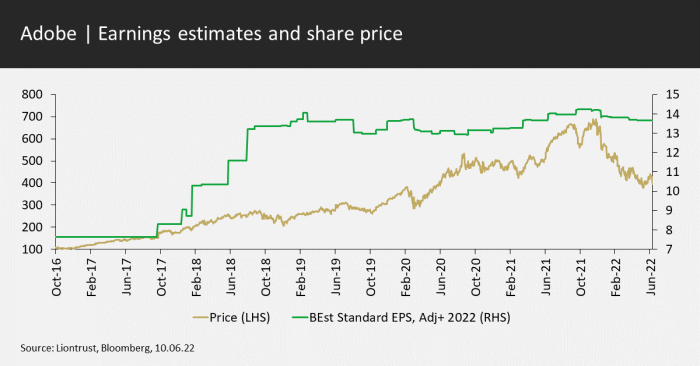

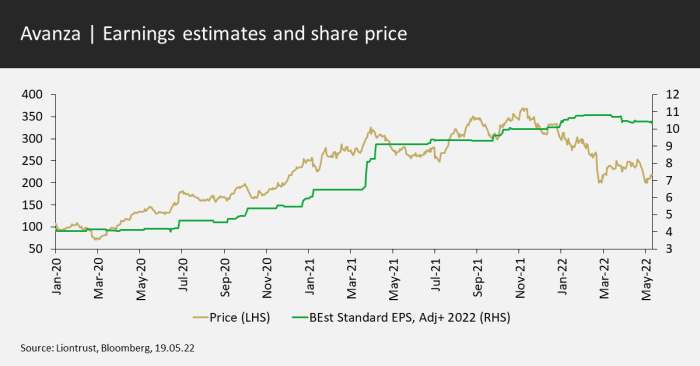

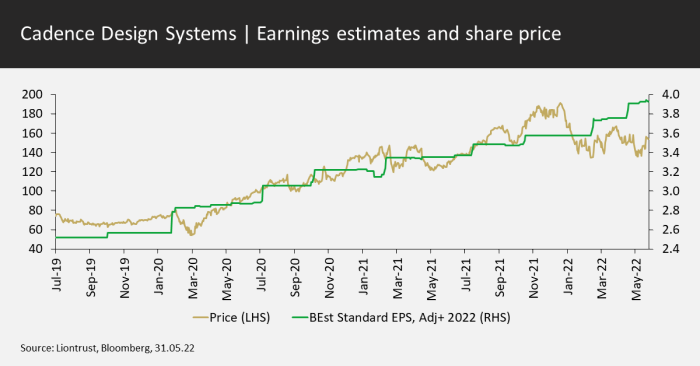

To put some evidence behind this, we show three of our core holdings in the following charts, highlighting that while these businesses are holding up well in terms of estimated earnings per share, their share prices have declined rapidly since the latter part of last year. By their nature, value stocks tend to re-rate relatively rapidly, and then it is done; our preference is for companies that can maintain high earnings growth and our belief is that the market will continue to reward these types of businesses with higher share prices over the long term.

Discrete years' performance*, to previous quarter-end:

Past performance does not predict future returns.

|

|

Mar-22 |

Mar-21 |

Mar-20 |

Mar-19 |

Mar-18 |

|

Liontrust Sustainable Future Global Growth 2 Acc |

5.7% |

42.7% |

3.3% |

19.0% |

6.9% |

|

MSCI World |

15.4% |

38.4% |

-5.8% |

12.0% |

1.3% |

|

IA Global |

8.4% |

40.6% |

-6.0% |

9.0% |

2.7% |

|

Quartile |

3 |

2 |

1 |

1 |

1 |

* Source: FE Analytics, as at 31.03.22, primary share class, total return, net of fees and income reinvested.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The decision to invest in a fund should take into account all the characteristics and objectives of the fund (inclusive of sustainability features) as described in the prospectus.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.