US inflation has hit 40-year record levels this year. The extent to which the Federal Reserve will hike rates to counter price rises is the key issue facing investors in the world’s largest economy this year. But is US inflation set to run away, or are there factors at play that will dampen it in the coming months, allowing the Fed to ‘pivot’ and take a less harsh position on the economy?

The main contributors to US inflation

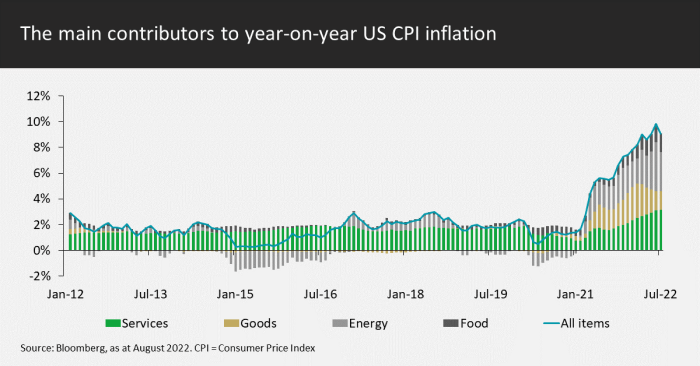

There are five main categories that contribute to the US Consumer Price Index (CPI), as shown in Fig. 1 below. Prior to Covid, CPI was mainly driven by inflation in the Services sector. Commodities such as Food and Energy fluctuated but they were relatively minor contributors over time. Goods was a disinflationary category for many years with ever-improving functionality in consumer electronics and cheap imports flooding American shelves.

But in 2021, Covid hit supply chains. Goods inflation spiked higher as economic stimulus measures stoked demand and retailers struggled to replenish shelves. Food and Energy prices grew strongly as transportation bounced back after lockdowns and OPEC+ exhibited strong discipline in maintaining agreed cuts to oil production. Services inflation also increased as shelter inflation climbed with rising house prices and rents.

Fig. 1

Source: Bloomberg, August 2022

Going forwards, what impacts will each category likely have?

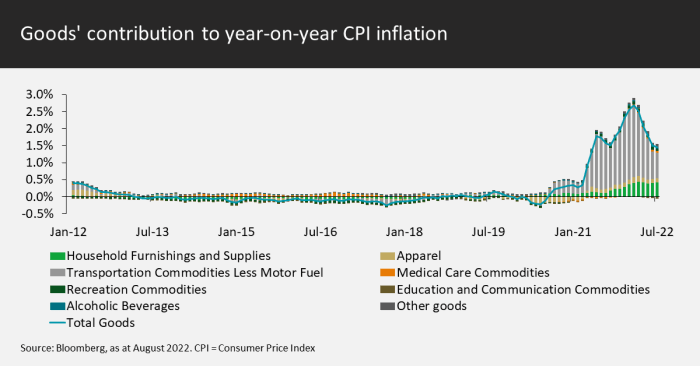

Goods inflation could turn into deflation

The biggest contributor post-Covid to Goods inflation has been new and used cars (see Fig. 2). This has been driven by the well-documented semiconductor shortages in the autos supply chain, which has limited production of new cars. The lack of supply of new cars has driven up prices for used cars.

The Manheim Used Car Index indicates that US used car prices increased more than 60% in 2021. Clearly, this environment is unsustainable. Used car prices will normalise in time and we have started to see prices softening in the first half of 2022. So far this has been driven by demand, but we expect used car prices to continue to normalise as supply improves in the coming months. The magnitude of the potential correction could even mean Goods becomes a deflationary contributor to CPI.

Fig. 2

Source: Bloomberg, August 2022

In other Goods categories, supply has improved as demand cools. There have been well-publicised excess inventory issues at retailers such as Walmart and Target. Retailers have had to start discounting again. Logistics bottlenecks are clearing and freight rates are beginning to normalise.

Input costs are also falling as metals prices have corrected sharply with expectations of slowing growth. The Bloomberg Industrial Metals Index has fallen 35% from its peak in early 2022. This should start feeding into Goods prices in due course.

Energy market set to remain oversupplied

Oil prices peaked in March and are now down more than 25%. The Russian invasion of Ukraine and the subsequent sanctions imposed by the west initially stoked fears of potential oil shortages. However, reduced demand for Russian barrels from Europe has been replaced by demand from India and China.

Oil supply is estimated to be in surplus as of Q2, according to the US Energy Information Agency. Oil supplies continue to grow, with non-OPEC+ countries adding an estimated 2.5-3mb/d this year. Meanwhile, oil demand is stalling as consumers shun record gasoline prices. Should we see a recession, oil demand could even fall.

Food inflation should slow

Food inflation should slow in the near term as agricultural commodity prices have also fallen in recent months. There tends to be a lag of up to six months before this feeds into grocery prices. In July, Turkey helped Ukraine and Russia reach a deal to resume grain shipments from Black Sea ports. This should help ease soft commodity markets.

Fed tightening is impacting housing market

Shelter inflation makes up about 60% of the weighting within Services inflation. It mainly consists of housing costs. It has been the main driver of the recent increase in Services inflation as house prices and rents rise.

There is a long lag between changes in house prices and Shelter inflation because of the way it is calculated by the Bureau of Labour Statistics. Furthermore, house price inflation itself lags broader housing market activity, such as Existing Home Sales volumes. Recently, we have seen a significant cooling in activity as mortgage rate rises driven by Fed tightening have impacted affordability.

Given these long lags, despite the sharp downturn in housing market activity in recent months, we will likely only see Shelter inflation peak towards the end of 2022 and it will likely remain high before fading in the back half of 2023.

Disinflationary forces are pressuring Goods, Energy and Food inflation

Despite sticky Shelter inflation, we see disinflationary forces providing downwards pressure on Goods, Energy and Food inflation in the near to medium term. This is driven by normalising supply chains, in particular normalising used car prices, and demand destruction for crude oil as economic growth slows. Indeed, recessions were historically disinflationary/deflationary affairs, and we think this time will prove no different should the current growth slowdown become a recession. Covid created a unique environment of increasing demand for goods from stimulus and lockdowns and constrained supply from bottlenecks. This is in the process of reversing as demand is hit by rising costs and fading stimulus, and supply chains ease with the addition of new capacity. This inflation may prove transitory after all.

For students of Milton Friedman, who famously said that “inflation is always and everywhere a monetary phenomenon”, you will be pleased to know that this view corroborates with the latest data on money supply. M2, a measure that includes cash and bank deposits, has decelerated from 27% annual growth at its peak to 5% in July.

Lower inflation could reduce the pressure on the Fed to raise rates and allow them to pivot to lower incremental rises or even pause. In this scenario, bond yields would likely decline and benefit higher multiple, growth-oriented stocks as discount rates fall. Recently, we added new positions in higher growth companies. One example is Intuit, the tax and accounting software provider. Its multiple has contracted significantly with higher bond yields. However, we believe the business should be resilient. Tax and accounting are not discretionary spends and the software as a service (SaaS) nature of the software should mean a steady revenue stream despite slowing economic growth.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in funds managed by the Global Fundamental Team may involve investment in smaller companies. These stocks may be less liquid and the price swings greater than those in, for example, larger companies. Some of the funds may hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio. Investment in the funds may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Some of the funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.