The future for sustainable investment

The future of sustainable investment has been questioned by a number of different parties recently. Yet, in contrast, we are more excited about the prospects for the sustainable themes and stocks we invest in than we have been for many years.

The criticism of sustainable investment follows a period of challenging performance for sustainable investment. Both equities and bonds in general delivered negative returns in 2022, the rise in inflation and interest rates have impacted growth stocks, and the dominance of the magnificent seven stocks have negatively affected funds with underweight positions in these companies on a relative basis.

Why sustainable investment?

Before we discuss performance and why we are so confident looking forward, we will reiterate why sustainable is a good characteristic to look at. The classic definition of sustainable development is “development that meets the needs of the present without compromising the ability of future generations to meet their own needs”.

Unfortunately, a look at where we are today shows that we are operating very far from a sustainable level. Over the nearly 50 years since that definition of sustainable investment was first set out, each generation has left a more depleted environment for the next.

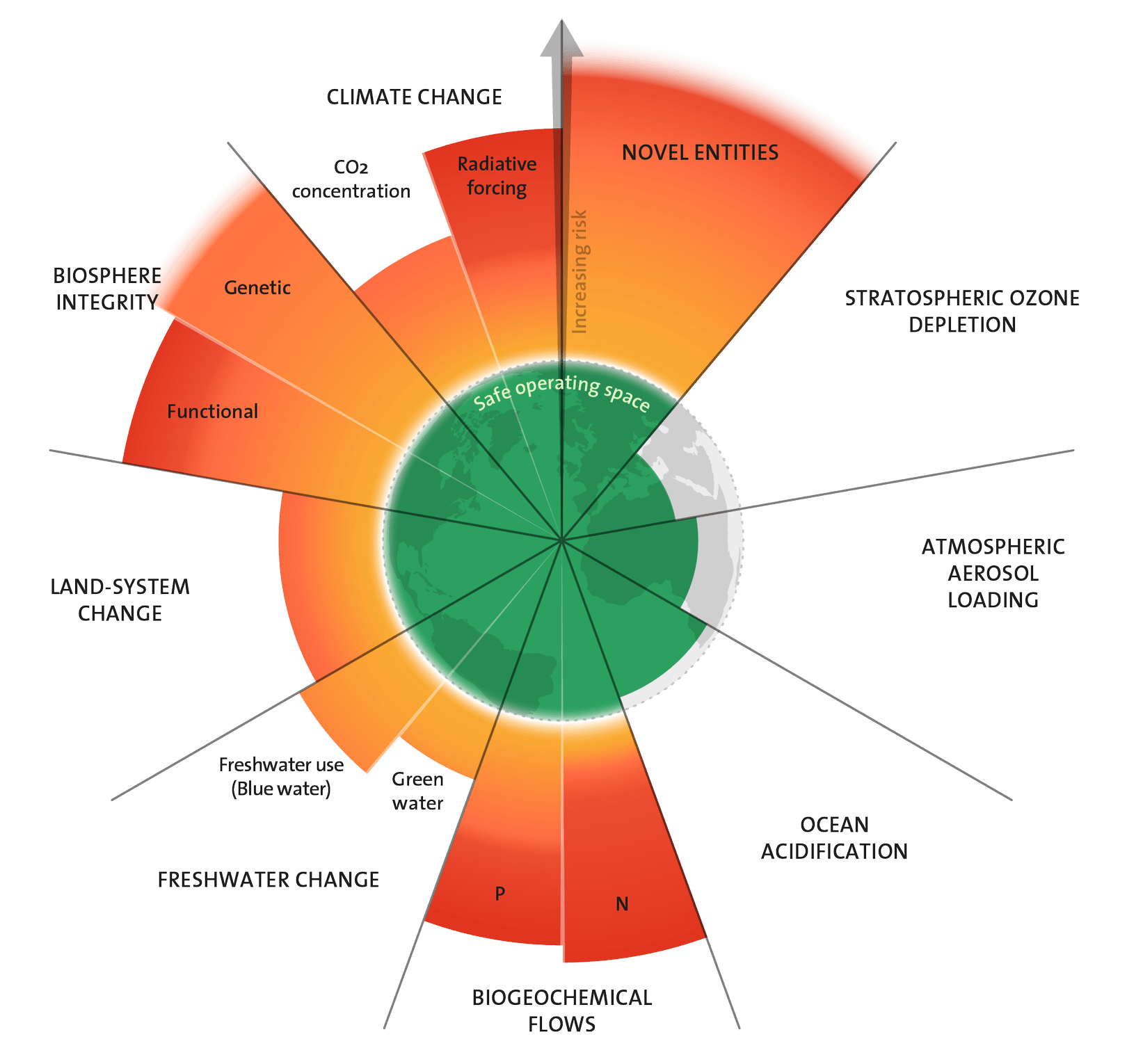

The image below, produced by the Stockholm Resilience Centre, demonstrates the scale of the issue. This sets out nine planetary boundaries – critical aspects of our planet that need to be preserved for long run prosperity.

Source: The 2023 update to the Planetary boundaries (licensed under CC BY-NC-ND 3.0). Credit: Azote for Stockholm Resilience Centre, based on analysis in Richardson et al 2023.

Categories that go beyond the green are where we are having more of an impact than our planet can handle long term. The chart shows that six out of the nine categories are notably beyond what can be sustained, these include biodiversity and climate change.

Focusing in on climate change only emphasises the scale of the problem. Worldwide, carbon dioxide emissions have risen by close to 40% since our sustainable funds were set up in 2001. Given the global warming potential of these emissions, this is clearly far from sustainable.

Reasons to be optimistic

But there are grounds for optimism as a look at one of those planetary boundaries within the green – that of stratospheric ozone depletion – shows. Previously, the ozone hole was a huge problem but the control and reduction of ozone depleting chemicals under the Montreal Protocol is now on track to allow the ozone hole to recover in the coming decades.

Equally, a closer look at emissions data shows that in Europe there has been a 20% decline in absolute emissions since 2001. When it comes to capital expenditure on electricity generation the direction of travel has firmly changed, with around six times more being spent on renewables than on coal or gas. The international energy agency has also highlighted that solar photovoltaic energy is the cheapest electricity in human history.

The role of business

Behind the positive change are a number of factors, not least the interplay between science and understanding, government and society and business.

In particular, business has an essential role to play in innovating and refining solutions and extending the limits of what is possible. This emboldens governments to drive for further change. Over the years, this has led to safer roads, cleaner city air, clean drinking water, reduced childhood mortality and the acceleration that we have seen in renewable energy and in arresting the decline of the ozone hole. Investing in and supporting these businesses is where sustainable investing comes in.

Investment outcomes

While sustainable investment is still a small proportion of the overall market, it can have a disproportionate, catalytic effect.

At Liontrust, we state that we aim to deliver strong returns by investing in sustainable companies. We believe there is an advantage in sustainable businesses that tends to be underappreciated by the market. We use this to drive strong returns from our strategies and the long-term track record of our strategies – in equities, in fixed income and in managed funds – remains strong and this is evidence that the businesses we back have done well.

Looking to the future, it is not hard to see that those businesses which are providing the solutions will potentially access vast growth opportunities. In many cases, the speed and scale of this growth is likely to be underestimated in the valuation of their shares.

This is where the opportunity lies – finding great companies and helping to solve challenges we face as a society and world, whose prospects are undervalued by the market.

As we said, in the context of the last 23 years that we have been managing the sustainable future strategies, the last three years have been particularly dramatic.

Our sustainable investment strategies, with their focus on growth and avoiding oil and defence sectors, have been negatively impacted by the investment and economic environment of the last year or so. We are confident, however, in the longer-term performance of all our strategies. This is supported by the valuations of the stocks we hold, which are at multi-year attractive levels. We also still expect strong growth from our companies as generally they are performing well operationally and we believe this will be reflected in future share prices. This comes as growth is likely to be scarce across the economy over the next few years.

We believe interest rates are at peak levels and should fall towards the central banks’ targets by mid to late 2024. The current higher interest rate environment will likely lead to lower economic growth, and we believe there will be cuts in interest rates earlier than the market expects. This will help fixed income investments in terms of total returns and our funds should benefit from our current overweight position to duration.

For these reasons, we are confident about the outlook for our sustainable investment strategies and that they will build on their long-term positive track record as they back those businesses which are growing profitability while delivering solutions to critical environmental and social problems.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.