Europe was one of the best performing regional equity markets last year and we think the outlook for 2024 is equally positive. A combination of a technical uptrend, reasonable valuations and benign corporate aggression provides a supportive backdrop. Within this, we believe the style leadership of the market is finely balanced. Whichever direction the market takes, we are confident that the investment process will allow us to adjust swiftly to a dynamic environment.

Europe was among 2023’s best markets as global growth businesses shone

Amid a ‘risk-on’ mood towards the end of last year, European shares rallied strongly to record one of the better returns amid a global equity rally. The impressive 14.8% sterling-terms performance from the MSCI Europe ex-UK index over 2023 placed it ahead of the MSCI Japan (+13.5%), the UK’s FTSE All Share (+7.9%), the MSCI Asia Pacific ex-Japan (+1.3%) and the MSCI Emerging Markets index (+3.6%). Europe only lagged US stockmarkets, where the S&P500’s 18.6% gain was driven to a large degree by the tech-heavy ‘Magnificent Seven’ mega cap stocks.

Conversations around the prospects of investing in European stockmarkets can sometimes be tainted by the outdated misconception that this region is dominated by ‘old economy’ stocks such as financials, commodities and autos. This stereotype ignores the reality that sectors such as health care, technology and industrials have grown in prominence in recent years, offering plenty of opportunities for investment in global, growing businesses as well as more traditional areas.

A glance at the MSCI Europe ex-UK leaderboard for 2023 shows the top positive contributors were Novo Nordisk, the Danish pharmaceutical group, ASML, the Dutch manufacturer of machines used in semi-conductor production, and SAP, the German enterprise software company.

Cashflow Solution indicators now point to a constructive European market outlook for 2024.

Looking forward to the rest of 2024, we think the outlook for European markets is constructive but finely poised.

One of the proprietary indicators we use to identify the prevailing market regime is a technical measure of market momentum. By this metric, European markets entered an uptrend during 2023 and have remained in one since.

From a valuation perspective, we think European equities are around fair value: not exceptionally cheap but not at stretched levels either.

In our view, an uptrending market in combination with undemanding valuations provides a benign backdrop for equity investors.

Another of our market regime indicators – corporate aggression – is also supportive of the idea that European markets can continue to make further progress in 2024. We study how corporate mal-investment evolves through time as we think it is a good indicator that highlights when companies are being too bullish in their expansion and investment activities, and are at risk of falling short of their own ambitious growth targets. We quantify and measure corporate aggression by analysing cash flow statements for signs of over-confidence in capital expenditure or business investments.

Having previously been at a high level as businesses experienced supportive demand conditions during the economic recovery from Covid – leading to a surge in the number of companies over-committing capital to capture this demand – corporate aggression fell sharply in 2023 and is now back to unconcerning levels.

This combination of a technical uptrend, reasonable valuations and benign corporate aggression should continue to be positive for European equity markets in 2024.

Secondary scoring system allows us to optimise style trend exposure

From a style factor point of view, we see a balanced outlook between growth and value.

When we think about our funds’ style exposure, we use a scoring system to categorise companies’ cash flow profiles. We call this our secondary scoring system. The primary screen in our investment process is to rank the European equity universe on two key cash flow ratios in order to create a ‘Cashflow Champions’ watchlist of the top 20% stocks of cash generative stocks. We then use the secondary score system to characterise these stocks as possessing Momentum, Cash Return, Recovering Value or Contrarian Value appeal.

We then examine our market regime indicators to determine which combination of secondary scores are likely to work best in the prevailing market environment and which secondary scores can be safely ignored.

Over a decade, this system has given us great style flexibility

This year marks the 10th anniversary of our introduction of the secondary cash flow scores to the Cashflow Solution process. The big advantage of this system is that it helps remove our natural style biases as fund managers and imposes on us the discipline to respond intelligently to the prevailing market environment.

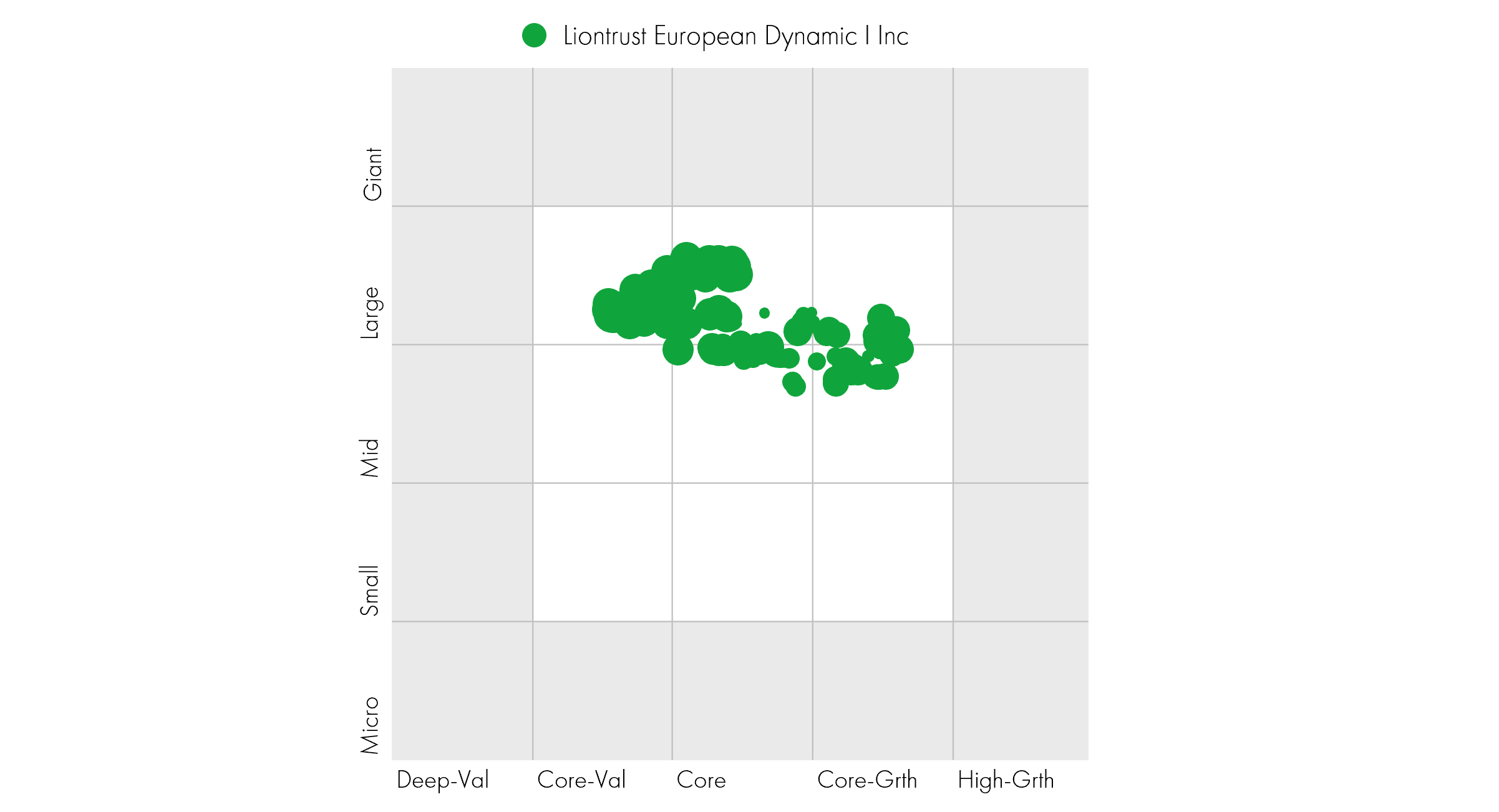

The holdings-based style trail chart below shows how – according to Morningstar’s style classifications – the Liontrust European Dynamic Fund has adopted a range of style biases over the last decade, responding to the investment backdrop at any given time.

Holdings based style trail since January 2014 (Introduction of Secondary Scores)

Source: Morningstar, 31 December 2023

The regime indicators led us to tilt heavily towards the Contrarian Value score during Covid

In recent years, the market regime indicators have given us a clear steer on the popular debate of value versus growth styles. In the early months of Covid, for example, a capitulation in share prices of value stocks together with a spike in investor anxiety reflected the huge uncertainty faced at the time. Through the prism of our investment process, this uncertain and seemingly chaotic environment presented a compelling buying opportunity for value-style businesses – solid companies that faced exceptional short-term trading challenges but which had a long-term history of cash flow generation in excess of their investment needs.

In the aftermath of Covid, our regime indicators correctly anticipated a big rally in contrarian deep value stocks as the economy slowly but surely recovered from the impact of Covid and lockdown measures. This benefited our portfolios as investors rapidly factored this recovery into the valuations of beaten-up value stocks. Over the course of 2021 the value rally evolved. As economies recovered from the brutal effects of lockdown, investors became more discerning – only rewarding cheap companies that were able to deliver on their earnings expectations. We identify stocks fitting this description with our Recovering Value score and see these types of opportunity as being quite distinct from a more contrarian value approach to investing. We continue to believe that Recovering Value is positioned to perform well in 2024.

The style outlook is now more balanced but we stand ready to adjust to market developments

Entering 2024, we’re now in a position where value stocks have re-rated from their extreme low levels but are not yet expensive. Our investor anxiety measure is now close to the long-term average, suggesting a less compelling environment for value compared with prior years where investor nervousness was creating a significant opportunity in contrarian stocks.

Meanwhile, stocks with high forecast growth style characteristics are no longer expensive but are also not compellingly cheap. One of our most rewarding positions in recent years had been to be underweight these stocks in long-only portfolios and short of the worst examples of expensive and over-ambitious growth in long/short portfolios.

If we were to oversimplify the investment universe into a choice of growth versus value, we currently see little reason to take a high conviction overweight position in either. This means that we don’t think this is the right environment to pursue a Contrarian Value strategy. In the current environment, we think the two secondary scores likely to perform the strongest are Momentum and Recovering Value. While we don’t believe this is the best environment for Cash Return stocks, we are happy to own a handful of these types of stocks in our portfolios for diversification.

Depending on how our market regime indicators develop, we will adjust the portfolio’s style profile to respond. This means that whatever 2024 holds for investors in European equities, we are confident that the investment process will allow us to adjust swiftly to a dynamic environment.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term. "The Funds managed by the Cashflow Solution Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. May target an absolute return. There is no guarantee that an absolute return will be generated over the time period stated in the fund objective or any other time period.

The risks detailed above are reflective of the full range of Funds managed by the Cashflow Solution Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.