The Liontrust Strategic Bond Fund returned -0.5%* in sterling terms in March. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was -0.1%.

Was it something we AIT?

March saw the continuation of the reflationary theme throughout financial markets. US Treasury 10-year yields rose 34 basis points, taking the total increase for the first quarter to 83 basis points. With the starting yield so low, this produced the worst quarterly return for US Treasuries since 1980.

A spike in US inflation in April and May is mathematically inevitable due to the year-over-year change in energy prices; headline CPI could reach 3.5% with core around 2.5%. The more important consideration is the direction of CPI in the months and years after this spike. We believe that inflation will prove to be sticky above 2% in the US for a few reasons. Firstly, there is a lot of economic stimulus still working its way through the system, both fiscal and monetary in nature. Secondly, related to that point, there is a global recovery gathering pace creating shortages in inputs; sustained higher producer price inflation (PPI) will feed through to consumer price inflation (CPI).

Inflationary pressures in services had dropped during the crisis for obvious reasons connected to lockdowns; as the leisure sectors re-open, those businesses that have survived will seek to rebuild profit margins and balance sheets through raising prices. There is a huge pent-up desire for leisure activities; demand will outstrip supply even with some consumers likely to be more cautious about returning to life in public spaces again.

The classic inflationary feedback loop is wage inflation. The nuance we presently have is that additional income is not necessary to boost demand. There was already over US$2 trillion of excess savings in the US alone, and that was before the latest Biden stimulus cheques arrive. In aggregate, this savings pile will be spent over the next few years, providing a strong impulse to consumption. Wage inflation itself is actually likely to fall as the leisure sectors reopen, entirely due to the industries involved employing a greater proportion of lower paid labour; this is a simple averaging impact.

Any form of protectionism, or trade barriers erected, will structurally add to price pressures too – a reversal of the disinflationary tailwind that globalisation has created for the prior decades. Technological advancements will continue to exert downward pressures on prices in most industries; this mega-trend will not dissipate, but there are enough other factors at work to conclude that an overshoot of inflationary targets should occur for the next few quarters.

Financial markets are involved in a battle, or maybe one could call it a negotiation, with the Federal Reserve about how high Treasury yields can go until the Fed intervenes. The Fed has explicitly stated that it would like to see inflation above 2% for a sustained period to compensate for prior shortfalls; that is what average inflation targeting (AIT) means. With the Fed being likely to tolerate higher inflation, what would the trigger be for it to want to cap or reduce market yields? A steeper yield curve can aid growth, through boosting the banking sector’s profitability and investor confidence in the recovery. It is only when yields have risen enough that it begins to either choke off growth, or threaten to, that the Fed would be catalysed into action. The two most prominent transmission mechanisms would be a significant slowdown in US housing activity relating to higher mortgage rates, or a taper tantrum that led to a 10% plus fall in US equity indices; the latter is the most likely trigger in my opinion.

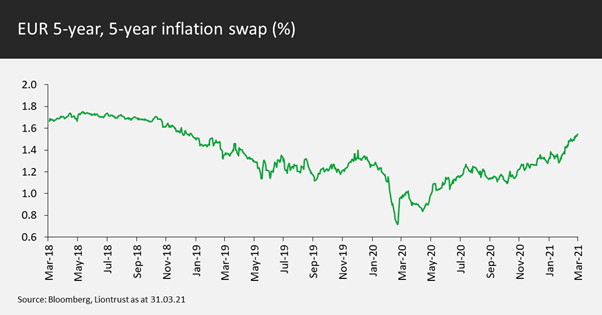

It would be remiss of me not to mention the ECB, which has increased the pace of its PEPP purchase program to alleviate upward pressure on bond yields. The ECB has not yet mentioned increasing the size of the PEPP, so this is presently just a front-loading of the purchasing. In the broad, eurozone inflation might not overshoot the 2% threshold, but similar pressures to those seen in the US are also building. As vaccine supply picks up in Q2, the battle between bond markets and the ECB might begin in earnest. In the meantime, ECB officials will be taking pleasure in the rise in inflation expectations as vindication of the markets’ view on their policies for the economic recovery. The ECB’s preferred measure is to look at 5-year, 5-year forward inflation swaps, which takes out the idiosyncratic “noise” in the early years. This measure shows the expected average level of inflation over five years, beginning five years in the future (so covering a period 5 years from now until 10 years from now). The rise in market expectations here is clear to see in the chart below. Ultra-loose monetary policy combined with expansionary fiscal policy leading to inflation, who could possibly have predicted that?

So, for the foreseeable future, the negotiation between the financial markets and central banks will continue. Rates markets volatility and direction will be key for almost all financial assets.

Rates

Any bond fund correlated to bond-type risks should have lost money year-to-date. High yield, a cousin of equities, is up as the yield carry and tightening credit spread impact has outweighed the rates move. The Fund has preserved capital better than indices, a function mainly of having lower duration. Additionally, it has been about taking duration in the right places; we had reduced US duration below 2 years in February, tactically preferring the lower rates’ beta of core eurozone bonds. To be clear, we still think Bunds are horrendously overvalued – it was purely about sheltering from the US storm by reducing the European short.

Furthermore, we have had a strong yield curve preference for the 5 to 15-year maturity bucket, particularly the 5 to 7-year area where the curve is steep and there is a decent roll-down dynamic towards anchored base rates. We view the long end as being most vulnerable to the reflationary trade; the Fund has zero net exposure to US duration of over 15 years with the contribution from any longer-dated credit hedged out using treasury futures.

Overall Fund duration was edged up by a quarter of a year during March to 3.5 years†, reflecting the increased value in government bond markets. But – and a very important but – the markets on any longer-term measure are still incredibly expensive. Our neutral duration position is 4.5 years and the index is above 7.25 years. We have tactically reduced the size of the short. If the US 10-year traded back towards 1.5%, we would sell rates risk again; we would not seek to add further to duration unless the US starts testing the 2% yield area.

Allocation

Overall asset allocation was little changed over the month. The Fund holds 40% net in investment grade credit, split between 45% in physical holdings and a 5% risk-reducing overlay. This is below our neutral weighting of 50% as we believe that, at some stage, all risk markets will react to rising government bond yields. Or, to put it another way, whilst the fundamentals of the asset class are robust, we anticipate a period of mark-to-market volatility which will create a buying opportunity.

High quality, high yield is our favoured part of the myriad markets that offer a credit spread. The Fund owns 20% of its assets in high yield, in line with our neutral positioning. We are avoiding maturities longer than 8 years as in a rising government bond yield environment, longer-dated high yield becomes friendless!

During March we took profits on the cross-market CDS index position. As a reminder, the Fund was long risk European high yield (using iTraxx Xover) versus short risk US high yield (using CDX HY). The spread between the two widened from roughly 50 to 60 basis points, thus netting the Fund about 5 basis points of alpha. This is obviously not a huge amount; but in a year in which decent bond total returns will be hard to generate, low risk incremental gains will all add up over time.

Selection

The credit market continues to see an abundant supply from new issues. The typical pattern is for any new bond deal to be initially offered with a significant yield, or spread, concession to where comparable bonds are trading in the secondary markets; but order books then swiftly become hugely oversubscribed and the pricing tightens, thus eroding all the initial perceived value. With a concentrated portfolio, we have neither a need nor desire to participate in most of the primary deals we are shown. When we do commit the Fund’s money, we set a price limit, which is frequently binding, i.e. our order gets pulled when the bonds become too expensive.

Our very selective approach did find value in two new investment grade issues in March. Firstly, we bought a 10-year US dollar bond issued by Oracle. This software giant has taken the active decision to increase shareholder rewards, effectively moving itself from single A to triple BBB credit metrics. Buying the debt after this decision had been made offered a good entry point for such a high-quality business. Secondly, London Stock Exchange Group (LSEG) came to the market to refinance their acquisition of Refinitiv. A small spread premium was left on the table for investors with the Fund mainly participating in a 12-year euro-denominated bond. LSEG will rapidly deleverage over the next two years as it integrates Refinitv, generates cash and sells off Borsa Italian Group; this should lead to its credit spread gradually tightening over time.

The sales side of the ledger saw the Fund exit two tobacco holdings, namely BATS and Altria. Both bonds had performed strongly, so it was good time to take profits. Furthermore, with the advent of SFDR, we have increased ESG exclusions in the Fund to include tobacco and coal as well as the existing screen for weapons. The Fund scores well on the ESG front, not because of being an explicit “green” fund, but because of the way in which we select bonds. Our ESG process and philosophy is rooted, we believe, in sound investment rationale and is therefore embedded into our process for investment reasons.

Discrete 12 month performance to last quarter end (%)**:

|

Mar-21 |

Mar-20 |

|

|

Liontrust Strategic Bond B Acc |

12.5% |

-3.0% |

|

IA Sterling Strategic Bond |

12.4% |

-1.3% |

|

Quartile |

2 |

3 |

*Source: Financial Express, as at 31.03.2021, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 31.03.2021, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.