The Liontrust GF Strategic Bond Fund returned 0.7% in US dollar terms in April. The average return from the EAA Fund Global Flexible Bond (Morningstar) sector, the Fund’s reference sector, was 0.1%.

Market backdrop

The reflationary theme continued to be a dominant force impacting financial markets in April. The acceleration of the vaccination rollout in Europe is great news for both economic activity and the population’s health and mortality rates. It is not good news for European bond yields as it becomes clear that a monetary policy stance designed for crisis management is not sustainable forever. The ECB may not expand its PEPP bond buying programme; a decision on this is anticipated in June. 10-year German Bund yields rose nine basis points to finish April at -0.20%.

On the other side of the Atlantic, US Treasuries actually rallied 11bps lower during the month. I would characterise this as not so much that yields had risen too far, but that they had risen too fast and were due a rebound. A Federal Reserve that is targeting average inflation and crowded short investor positioning added to the impetus for the small rally.

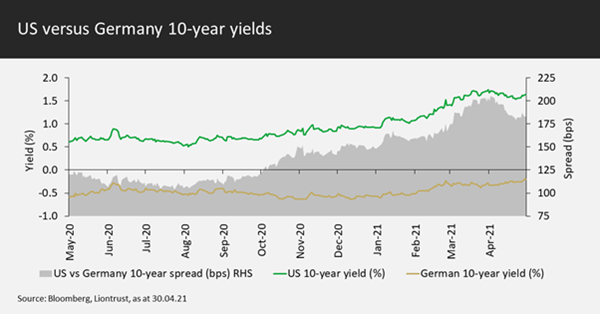

It is unusual for US yields to fall when German ones are rising, and vice versa, but it can and does happen. The chart below shows the respective 10-year yields over the last year and the area (plotted on the right-hand axis) is the differential between the two. The US has clearly been a laggard, driven by being earlier into the reflationary trade, led by a faster vaccination rollout. April is a good example of how, in a global economy, this relationship can become too stretched and snap back at times.

There will be further tests of this relationship over the coming few quarters as central bankers look to take their foot off the accelerator at different times. It is worth remembering that tapering is about slowing the pace of monetary easing (central banks expanding their balance sheets at a slower pace) as opposed to actually tightening; it is, however, naturally seen as a significant signpost towards a change in monetary policy direction. The Bank of Canada announced a tapering of purchases during the month, setting a good example to its neighbours in our opinion!

The monetary policy responses to the ongoing reflationary trend will continue to cause bond markets to oscillate. This should create myriad alpha opportunities, but a low duration beta is still desirable as sovereign bond valuations remain incredibly expensive.

Rates

The Fund continues to run with a low duration, maintaining a correlation to rates markets but very much in the capital preservation mode. After the selloff in US Treasuries in Q1, the worst quarterly return for Treasuries for over 40 years, we increased the Fund’s duration to 3.5 years†. The rally, particularly toward the middle of the month, enabled us to take profits on duration additions; the Fund finished April back down at 3.0 years, way below our 4.5-year neutral position or the index’s 7.4-years’ worth of interest rate risk. There was a modicum of curve flattening during April, so our duration reduction was mainly from the 30-year tenor. We also tactically switched some US exposure into Europe to capture the relative moves.

We mentioned above the Bank of Canada tapering its quantitative easing programme. The Fund has been short Canada relative to other dollar-bloc markets, which has been beneficial for performance. Some profits were taken on this position during April, including on the curve steepener where the Fund owned 5-year Canadian bonds and was short the 10-year bond future. The sale of the bonds has left the Fund with a higher cash balance at month end which we look to deploy when a suitable opportunity arises.

Allocation

The Fund’s asset allocation was unchanged during April. The Fund holds around 43% net in investment grade credit, split between 48% in physical holdings and a 5% risk-reducing overlay. This is below our neutral weighting of 50% as we believe that there will be a better buying opportunity caused by a taper tantrum, or another risk event, that creates a long overdue pause in the financial markets’ grab for yield. The fundamentals of the asset class remain robust but valuations – credit spreads – are expensive so we’d seek to use periods of mark-to-market volatility to increase the Fund’s weighting.

High-quality high yield is our favoured part of the myriad markets that offer a credit spread. The Fund owns 22.5% of its assets in high yield, a little over the 20% neutral positioning. We like bonds with a good spread breakeven, the amount the credit spread could widen by on the bond over the next year without damaging the excess return (e.g. a corporate bond with a spread of 250 basis points and duration of 5 years could see its spread widen by 50 basis points before the annual excess return is wiped out). This naturally leads us to avoid longer-dated high yield bonds, those with over 8 years to maturity, as the breakeven is poor.

Selection

Credit markets continued to see a copious primary supply during April. The Fund is highly selective within its credit holdings, so we are quick to dismiss most issuance as being of little interest. There was one notable exception during the month, the Australian company NBN Co. NBN is a government-owned corporation which was created in 2009 to build a high-quality broadband network in Australia, a task now nearing completion. NBN owns critical infrastructure within Australia, has a well-defined regulatory regime and rapidly improving credit metrics. The new US dollar bonds issued during April represented its first bond issuance outside of Australia; the lack of investor name familiarity with the company meant that a spread premium was left on the table, one we are very happy to capture.

Selling activity was low. We took profits on a small holding in euro-denominated Becton Dickinson bond. In high yield we bid farewell to Allfunds’ bonds. The company called the bonds post its successful IPO; the position has been a great long-term return generator for the Fund, so we were sad to see the bonds leave.

Discrete 12 month performance to last quarter end (%)**:

|

|

Mar-21 |

Mar-20 |

|

Liontrust GF Strategic Bond B5 Acc |

13.2 |

-0.4 |

|

EAA Fund Global Flexible Bond - USD Hedged |

13.2 |

-1.9 |

*Source Financial Express, as at 30.04.21, total return, B5 share class.

**Source Financial Express, as at 31.03.21, total return, B5 share class. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality, the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.