The Liontrust Strategic Bond Fund returned 0.2%* in sterling terms in May. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was also 0.2%.

Market backdrop

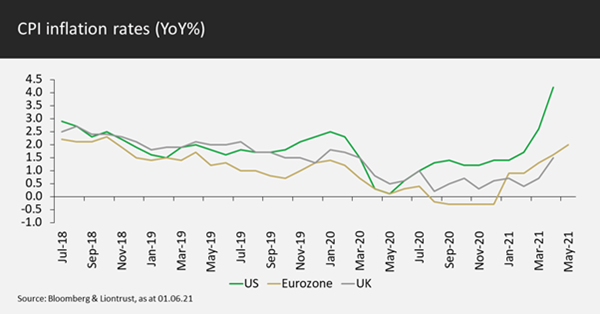

US inflation data for April 2021, released in May 2021, was always going to be way above the Fed’s 2% long-term target, a function of base effects from the crisis occurring a year earlier. The headline figure of 4.2% was comfortably above forecasts, yet the bond markets shrugged it off, clearly believing it to be transitory in nature. May’s advance Consumer Price Index (CPI) estimate for the eurozone, released on 1st June, has CPI at 2%, a rate that had not been seen since late 2018. So, the big question is whether this inflation will prove to be a blip, or whether some driving forces are not so transitory.

As mentioned, some of the increase is due to base effects; this is particularly the case with regards to energy prices. However, supply bottlenecks are occurring throughout the goods sectors. There was a lot of press attention during the month on the rising costs of building materials – my colleague David Roberts bemoans the 25% increase in the cost of his decking during a two-week period in May! What is clear is that demand for many goods is comfortably outstripping supply. This is likely to continue as other economies join the US in the re-opening trend. In my opinion, a demand impulse will also last for a few years as excess savings are gradually spent. Obviously, a lot of the pent-up demand is for services. Here again there are signs of price increases coming through as those businesses that survived the crisis look to rebuild profits. Some market commentators dismissed the US inflation numbers due to OERs (owner equivalent rents, a proxy for housing costs in the US which constitute a large part of CPI) coming in with inflation at “only” 2%. I have a simplistic view on this: if the supposed laggard is at 2% then the overall average will be way above 2%. Furthermore, the momentum in OERs is upwards. Summarising, we believe that inflation will be sticky, although US numbers won’t stay at 4.2%. They will also not fade to 2% for at least the next year. Some of the inflationary forces are structural rather than cyclical.

I have deliberately been using the word transitory to describe whether the increase in inflation is temporary. The reason for this is that it is the word that central bankers have been using. On a recent webinar I was asked how long transitory actually meant. Clearly there is no formal definition; my hypothesis is that if inflation is still at elevated levels – above 3% in the US – by late August/early September, then it will concern the Fed. The Fed’s Jackson Hole meeting in late August has sometimes been used to convey a change in policy over the last few years – it could be set in 2021 to be a milestone for the Fed to signal an impending tapering. Obviously, if inflation expectations become unanchored before then they might have to act sooner, but my central case is for a late-summer US monetary policy change.

Rates

Rates markets exhibited remarkably low volatility during May, with yields staying within a very narrow range. It was definitely a month for focussing on the alpha rather than beta. The Fund’s duration oscillated between 3 and 3.25 years, finishing the month at the lower of the range. 30-year US yields did see a little more movement intra-month during May, so we traded the US ultra (30-year) future to squeeze out a few extra basis points of performance. By the end of the month, the Fund was back to owning net zero duration in the US over 15-year maturity bucket, much preferring the proverbial “belly of the curve.”

Cross-market positioning added value during May. Profits were taken on being long Australia versus the US. The Fund re-entered a Canada versus US box position: long Canadian 5-year debt versus the US and the inverse in the 10-year. Additionally, the Fund remains net short Canadian duration. In Europe, we took profits on half of the long Switzerland versus Germany position. France has been a recent laggard and we presently prefer taking eurozone duration there rather than Germany.

Allocation

The Fund’s asset allocation remained effectively unchanged during May. The Fund holds just under 40% net in investment grade credit, split between 43% in physical holdings and a 5% risk-reducing overlay. I repeat our stance from the last few months: “This is below our neutral weighting of 50% as we believe that there will be a better buying opportunity caused by a taper tantrum, or another risk event, that creates a long overdue pause in the financial markets’ grab for yield. The fundamentals of the asset class remain robust but valuations – credit spreads – are expensive so we’d seek to use periods of mark-to-market volatility to increase the Fund’s weighting.”

High-quality high yield is our favoured market within the fixed income universe. The Fund retained its 20% weighting in high yield – what we deem to be a neutral positioning. We are seeking opportunities to nudge this upwards by a couple of percent as opportunities arise

Selection

We view the proposed merger deal between AT&T’s Warner division and Discovery as highly beneficial for AT&T’s credit metrics, reducing overall debt and any supply overhang created by the mobile spectrum auctions earlier this year. We therefore decided to buy back into AT&T’s subordinated debt in euros – a very cheap bond. This reinvested some of the proceeds the Fund had received from Transdigm’s bonds being called.

On the relative value front, we switched out of Global Switch’s 2027 debt into its 2030 maturity for compelling terms. It is definitely not the most exciting trade you’ll read about this month; it is very much focussed on generating small incremental alpha for a negligible change in Fund risk.

Discrete 12 month performance to last quarter end (%)**:

|

Mar-21 |

Mar-20 |

|

|

Liontrust Strategic Bond B Acc |

12.5% |

-3.0% |

|

IA Sterling Strategic Bond |

12.4% |

-1.3% |

|

Quartile |

2 |

3 |

*Source: Financial Express, as at 31.05.2021, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 31.03.2021, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.