The Liontrust GF Absolute Return Bond Fund (C5 share class) returned 0.5% in sterling terms in Q2 2021 and the IA Targeted Absolute Return, the Fund’s reference sector, returned 1.5%. The Fund’s primary US dollar share class (B5) returned 0.5%.

The Q2 return takes the Fund’s year-to-date returns into positive territory despite the significant headwind of the 50 basis points rise in US Treasury yields. A combination of the yield carry on the Fund and alpha generation have been sufficient to offset the rise in government bond yields.

Market backdrop

The reflationary theme continued to be a dominant force impacting financial markets during the quarter. The acceleration of the vaccination rollout in Europe is great news for both economic activity and the population’s health and mortality rates. It is not good news for European bond yields as it becomes clear that a monetary policy stance designed for crisis management is not sustainable forever. On the other side of the Atlantic, US Treasuries actually rallied 30 basis points during the quarter. I would characterise this not so much as yields having risen too far, but that they had risen too fast and were due a rebound. The monetary policy responses to the ongoing reflationary trend will continue to cause bond markets to oscillate.

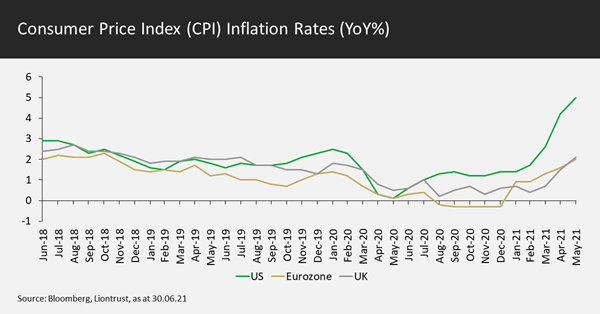

US inflation data for April 2021 was always going to be way above the Fed’s 2% long-term target, a function of base effects from the crisis occurring a year earlier. The headline figure of 4.2% was comfortably above forecasts yet the bond markets shrugged it off, clearly believing it to be transitory in nature. May’s figure then leapfrogged this, coming in at 5.0% – hence why inflation is such a hot topic for financial markets. So, the big question is whether this inflation will prove to be a blip, or whether some driving forces are not so transitory.

Some of the increase is due to base effects – this is particularly the case with regards to energy prices. However, supply bottlenecks are occurring throughout the goods sectors. What is clear is that demand for many goods is comfortably outstripping supply. This is likely to continue as other economies join the US in the re-opening trend. In my opinion, a demand impulse will also last for a few years as excess savings are gradually spent. Obviously, a lot of the pent-up demand is for services; here again there are signs of price increases coming through as those businesses that survived the crisis look to rebuild profits. Some market commentators dismissed April’s US inflation numbers due to OERs (owner equivalent rents, a proxy for housing costs in the US which constitute a large part of CPI) coming in with inflation at “only” 2%. I have a simplistic view on this: if the supposed laggard is at 2% then the overall average will be way above 2%. Furthermore, the momentum in OERs is upwards. Summarising, we believe that inflation will be sticky. Although US numbers won’t stay at 5.0%, they will also not fade to 2% for at least the next year. Some of the inflationary forces are structural rather than cyclical.

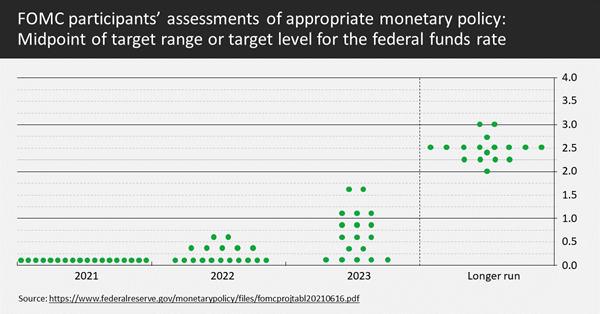

I have deliberately been using the word “transitory” to describe whether the increase in inflation is temporary; this is the word that central bankers have been using. There is no formal definition of transitory; my hypothesis is that if inflation is still at elevated levels – above 3% in the US – by late August/early September then it will concern the Fed. The Fed’s Jackson Hole meeting in late August has sometimes been used to convey a change in policy over the last few years. It could be set in 2021 to be a milestone for the Fed to signal an impending tapering. The first step on this pathway was made at the Federal Reserve meeting on Wednesday June 16th. There was a significant shift in the dot plots – the FOMC members’ projections of where they envisage future interest rates will be. The median for 2023 now predicts two rate rises:

It is no surprise that in the face of burgeoning inflation and a rapidly recovering US economy – even before further stimulus from an infrastructure package – emergency monetary policy stimulus will have to end sometime. With the Fed’s stated desire to make up for lost ground under Average Inflation Targeting, the hawkish tilt materialised sooner than market commentators were anticipating. However, the move merely validates what the front end of the curve had been pricing for a while and doesn’t guarantee that rate rises will occur. In my opinion, one should be forecasting an interest rate lift off in 2022 – other governors are likely to join the seven already predicting higher rates as the economy booms. Clearly this depends on a continued strong bounce back in employment.

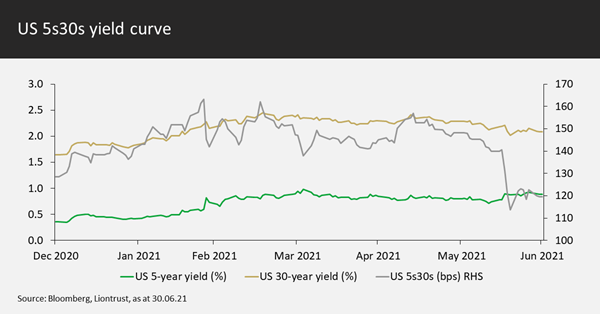

The bond market reaction was a classic curve flattening with 5-year yields, depicted in green below, rising to price in more rate rises. Yields on 30-year bonds, the gold line, actually fell based on the expectation that the Fed will dampen down longer-term growth and inflation.

The difference between the two tenors, measured in basis points on the right-hand axis of the graph, saw a dramatic move. This has led some economists to ask whether the Fed has made a policy mistake, but this is ludicrous as the Fed hasn’t even done anything yet. I continue to argue that a decade of monetary policy that is too loose has hugely impeded productivity growth: now that is a policy mistake!

It feels very early into the monetary cycle to start trying to predict where interest rates will peak. Certainly, with the amount of debt outstanding, rate rises have more marginal impact than in prior cycles. Set against this is our assertion that not all of the inflation we are witnessing is transitory in nature; some is structural rather than just cyclical. We do not expect exceptionally loose monetary policy to be brought to an end; we do expect the real value of government debt to be eroded away by higher inflation. This is classic financial repression, enabling governments to improve their debt metrics over time in a system rigged by central banks. In bond markets, the free ride on beta is over and fund managers will now need to produce more alpha to generate positive real returns for investors.

Carry Component

We split the Fund into the carry component and three alpha sources for clarity in reporting, but it is worth emphasising we manage the Fund’s positioning and risk in its entirety. As a reminder, the Carry Component invests in investment grade bonds with <5 years to maturity. Within this there is a strong preference for investing in the more defensive sectors of the economy.

Regarding the overall fund shape, with credit spreads at tight levels the proportion of the Fund in the Carry Component has been run in the 55-60% range. This has freed up risk budget to implement more alpha trades, particularly within rates.

Within the Carry Component we have a mild preference for Euro-denominated credit relative to US Dollar investment grade issues, this is purely based on the valuation metric of wider spreads. The value opportunity in US Dollar denominated floating rate notes (FRNs) has been realised; the Fund’s FRN weighting peaked above 40% approximately 2 years ago and now is below 0.5%. This residual holding matures this month. Thus, for valuation reasons, the Fund is back to accessing carry solely through conventional fixed coupon bonds.

Alpha Sources:

Rates

The Fund took profits in its long Swiss 5-year debt relative to the German 5-year BOBL future. With both countries being high quality AAA-rated sovereigns, this was a low-risk position. The mispricing corrected gradually, and as the spread between the two moved from 10 basis points to close to zero we successfully exited the cross-market trade.

Staying in Europe, the Fund retains its long Sweden versus Germany cross-market position; this was a small benefit during the second quarter. A new alpha trade was established: long French 10-year debt relative to Germany, a position which finished June a little onside.

Last quarter we discussed a successful Canada versus US box trade – long 5-year Canadian debt relative to US Treasuries with the opposite position on at the 10-year tenor. We re-entered the position in the quarter, successfully profiting on the 5-year leg and then reinstated it again, finishing the quarter with the pure box position back on.

In the broader dollar bloc, the Fund switched some of its US duration exposure into 3-year Australian debt. The Australian central bank has been controlling yields on the April 2024 bonds at 0.10%. We purchased the November 2024 bonds as their yield approached 0.40%. At this level they are already pricing in rate rises so offer a decent risk against return profile.

Allocation

There were no market-neutral allocation positions taken during the quarter. Valuation discrepancies tend to occur in periods of credit market dislocation. Asset allocation changes mainly occurred within the carry component with the shift from FRNs back into conventional fixed coupon bonds.

Selection

Returns from holdings in Selection were very much incremental in nature with no significant standout contributors. The Fund made a small profit on a Medical Properties Trust bond, a rare foray into the sterling denominated bond market. Two new issues were purchased toward the end of the quarter. Firstly, we bought an 8-year Euro bond issued by Vonovia. This was part of its acquisition finance for its purchase of Deutsche Wohnen, a fellow German real estate company. The deal gives the company better scale and Vonovia’s corporate bonds had underperformed in anticipation of the supply, so the new issue represented a good entry point.

The second purchase was a high yield bond issued by Vodafone. Even though Vodafone itself is investment grade rated the bond is subordinated and so slips into the high yield rating category. Corporate hybrids are higher risk instruments so only appropriate for this Fund when the valuation is compelling; this is the only corporate hybrid the Fund owns.

Discrete 12 month performance to last month end**

|

Jun-21 |

Jun-20 |

Jun-19 |

|

|

Liontrust GF Absolute Return Bond C5 Acc GBP |

1.6% |

2.1% |

1.9% |

|

IA Targeted Absolute Return |

7.2% |

-0.5% |

0.44% |

Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

*Source: Financial Express, as at 30.06.21, total return (net of fees and interest reinvested), C5 class.

**Source Financial Express, as at 30.06.21, total return, C5 class. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio

Fund positioning data sources: UBS Delta, Liontrust.

† Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

DISCLAIMER

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.