The Liontrust Strategic Bond Fund returned 0.3%* in sterling terms in June. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was 0.8%.

Market backdrop

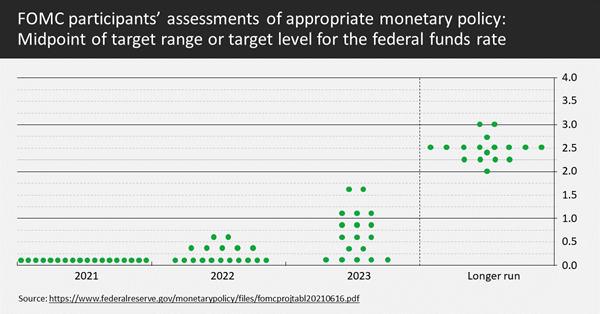

The bond market highlight for June was undoubtedly the Federal Reserve meeting on Wednesday 16th. There was a significant shift in the dot plots, the FOMC members’ projections of where they envisage future interest rates will be. The median for 2023 now predicts two rate rises:

It is no surprise that in the face of burgeoning inflation and a rapidly recovering US economy – even before further stimulus from an infrastructure package – emergency monetary policy stimulus will have to end sometime. With the Fed’s stated desire to make up for lost ground under Average Inflation Targeting, the hawkish tilt materialised sooner than market commentators were anticipating. However, the move merely validates what the front end of the curve had been pricing for a while and doesn’t guarantee that rate rises will occur. In my opinion, one should be forecasting an interest rate lift off in 2022 – other governors are likely to join the seven already predicting higher rates as the economy booms. Clearly this depends on a continued strong bounce back in employment.

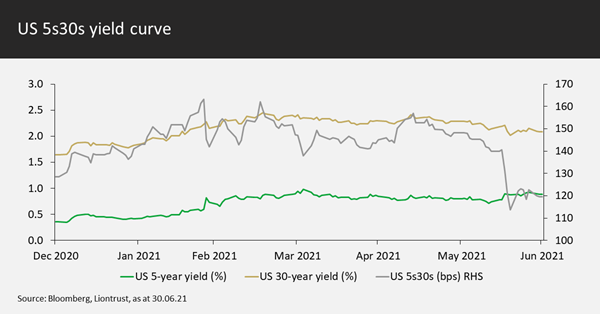

The bond market reaction was a classic curve flattening with 5-year yields, depicted in green below, rising to price in more rate rises. Yields on 30-year bonds, the gold line, actually fell based on the expectation that the Fed will dampen down longer-term growth and inflation.

The difference between the two tenors, measured in basis points on the right-hand axis of the graph, saw a dramatic move. This has led some economists to ask whether the Fed has made a policy mistake, but this is ludicrous as the Fed hasn’t even done anything yet. I continue to argue that a decade of monetary policy that is too loose has hugely impeded productivity growth: now that is a policy mistake!

It feels very early into the monetary cycle to start trying to predict where interest rates will peak. Certainly, with the amount of debt outstanding, rate rises have more marginal impact than in prior cycles. Set against this is our assertion that not all of the inflation we are witnessing is transitory in nature (see last month’s commentary); some is structural rather than just cyclical. We do not expect exceptionally loose monetary policy to be brought to an end; we do expect the real value of government debt to be eroded away by higher inflation. This is classic financial repression, enabling governments to improve their debt metrics over time in a system rigged by central banks. In bond markets, the free ride on beta is over and fund managers will now need to produce more alpha to generate positive real returns for investors.

Rates

Overall Fund duration finished June at 3 years† having been down to 2.5-year intra-month. The geographical distribution is split reasonably evenly between dollar-bloc economies and European exposure. On the former, the US is the largest exposure and there is a small contribution from Australia. During June we took profits on the 5-year leg of the Canada versus US box trade as the spread approached zero. We then reinstated it at close to a 10-basis point differential. The Fund remains net short Canadian duration relative to the US.

Within Europe, we sold the second half of our successful long Switzerland versus BOBLs (the German 5-year government bond future) position. We retained the Fund’s Swedish 10-year bonds which have started to perform relatively well. The rest of the European duration is in the eurozone with a minimal contribution from the UK.

We continue to dislike the long end of the yield curve and believe that some of the large move in 5s30s (discussed above) was simply due to some investors getting stopped out of loss-making steepening positions. The Fund’s long-dated duration exposure is low, with futures used to hedge out the duration contribution from credit in US Dollars, but still above zero. We prefer the belly of the curve – bonds with 5 to 15-year maturities.

Allocation

Once again there was little change in the asset allocation during the month. We await more volatility in credit spreads to trigger a better buying opportunity. The Fund holds approximately 41.5% net in investment grade credit, split between 46.5% in physical holdings and a 5.0% risk-reducing overlay (we deem 50% to be a neutral weighting). High quality high yield retains its position as our favoured market within the fixed income universe. The Fund has a 21.5% weighting in high yield, slightly above the neutral positioning of 20%.

Selection

We participated in two new issues during June. Firstly, we bought for the Fund an 8-year Euro bond issued by Vonovia. This was part of its acquisition finance for its purchase of Deutsche Wohnen, a fellow German real estate company. The deal gives the company better scale and Vonovia’s corporate bonds had underperformed in anticipation of the supply, so the new issue represented a good entry point.

The second purchase was a high yield bond issued by Vodafone. Even though Vodafone itself is investment grade rated, the bond is subordinated and so slips into the high yield rating category. Corporate hybrids are higher risk instruments, but we believe the coupon of 5.125% in US Dollars is enough to compensate for the extra risk and invested accordingly. I must emphasise that the Fund’s exposure to such subordinated debt remains very low, it is only when the valuation is particularly attractive that we will commit investors’ capital.

Discrete 12 month performance to last quarter end (%)**:

|

Jun-21 |

Jun-20 |

Jun-19 |

|

|

Liontrust Strategic Bond B Acc |

5.1% |

2.8% |

5.5% |

|

IA Sterling Strategic Bond |

6.1% |

3.8% |

5.3% |

|

Quartile |

3 |

3 |

2 |

*Source: Financial Express, as at 30.06.2021, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 30.06.2021, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

Key Risks