The Liontrust GF Strategic Bond Fund returned 0.6% in US dollar terms in July. The average return from the EAA Fund Global Flexible Bond (Morningstar) sector, the Fund’s reference sector, was 0.2%.

Market backdrop

The recent rally in government bonds and softening of economic data relative to expectations has stirred up a lot of debate in financial markets. We investigate this in more detail and address the sustainability of the reflationary theme in our latest strategy piece, from which we have extracted the executive summary below.

A slowing in the pace of growth and fears about the spread of the Delta variant of Covid-19 have recently led financial markets to question the reflation trade. We just view this as a tempering of over-exuberant market expectations. Ultimately, growth is still going to be very strong. Global activity is anticipated to expand by 6.4% in real terms and 9.8% nominally in 2021 according to JP Morgan. Examining the three largest drivers for economies currently: we are witnessing a boom in goods consumption with services accelerating as lockdown restrictions ease; inflation has jumped – a good proportion of which will prove to be structurally sticky rather than transitory – and employment is recovering, albeit with lower participation levels until people are enticed back into the labour force.

The bond market reaction to the shift in the reflationary narrative can neatly be summarised as duration having moved too far and credit being too sanguine about the price of risk. We have opposed the movement in government bond yields, taking duration in the strategic bond funds down from 3.5 years at the end of Q1 to 2.5 years at time of writing as US 10-year yields reside at 1.25%.

Investment grade credit is expensive compared to its own history and so fund weightings are below our neutral levels. There might not be an immediate catalyst for investment grade credit spreads to widen, but expensive valuations and stretched investor positioning sends us a strong signal that there will be a much better chance to buy in the future. High yield is better value provided one focuses on the quality end of the spectrum: excluding CCC-rated credits and the energy sector, the spread is just below 300 basis points. We retain our quality bias in high yield; the compression between CCC credits and BBs has gone too far and would rapidly widen in any period of risk aversion in the markets.

Rates

The Fund finished July a smidgeon below 2.5 years of duration. We retain our preference for the belly of the curve – bonds with a 5 to 15-year maturity. The Fund has low rates beta, but not zero beta - it is a bond fund, after all. With sovereign bonds being so expensive, our focus is on generating incremental returns from alpha. A good example was a new position instigated during July: long New Zealand 10-year debt relative to Australia.

Alpha example – New Zealand versus Australia

Most bonds have performed well during the Covid crisis – some because of purported safe haven status, other, more risky ones benefiting from central bank buying programs and positive fiscal support.

Of late, sovereign bonds have also rallied as fears of reflation abated. How country specific bonds have fared compared with one another owed much to individual government responses to the crisis. This variation created opportunity.

For example, UK gilts performed surprisingly well. Fears the Delta variant would lead to renewed lockdown created a rush for safe havens even with 80% of the population vaccinated. By late July, the data suggested that high levels of hospitalisation were not likely. We took the gilt rally as an opportunity to short the UK market, adding Canadian bonds instead.

We also see opportunity on the other side of the world. Aggressive lock down policies and a willingness to close borders meant Australia and New Zealand fared comparatively well during the crisis. Of late though, Australia has entered a further lockdown and the country witnessed protests over the slow pace of the vaccine roll out. Meanwhile, in New Zealand, sections of the economy look in bubble territory and the Reserve Bank is ending quantitative easing. All that impacted relative bond prices:

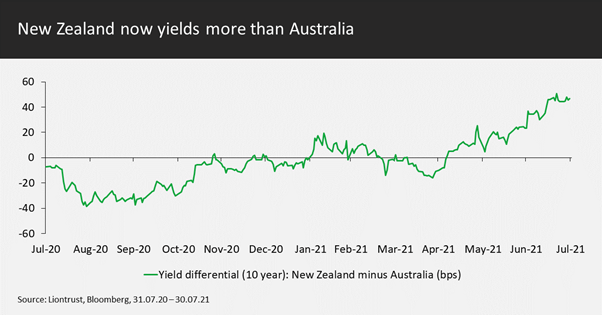

A year ago, New Zealand bonds paid 0.4% less than their Australian counterparts. Today, they pay around 0.5% more – that is an 8% relative price move. Now, compared with long term history, New Zealand does not look cheap; but versus Australia it does. So, instead of just buying the less expensive market we also shorted Australia using bond futures, having generally been long since we launched the fund in 2018.

If for any reason we see a move back to mid-2020 spread levels, that would give us a gain of close to 8% on the position in the Fund, without chasing market direction.

Allocation

The Fund holds 41.5% in investment grade credit, comprising 46.5% in physical holdings offset by a 5.0% risk-reducing overlay; we deem 50% to be a neutral weighting. Within this, there is our permanent preference for large, liquid bonds from listed entities. We continue to avoid chasing risk within the Fund by either issuer or aggressive bond structures. The one spread risk exposure we still like within credit is high quality high yield. The Fund has a 22% weighting in high yield, slightly above the neutral positioning of 20%. We are still avoiding the worst segments of the market by sector and rating. The Fund has zero exposure to CCC (and below) rated credit.

Selection

Activity at the stock level was low during July, with greater volatility in macro than micro markets during the month. The highlight was profitably trimming the recent Softbank US dollar new issue, leaving the Fund room to buy back on any weakness. Activity in financial markets tends to slow down during the summer. It seemed like for many the holidays started early in July and we expect August to witness lower turnover too before the September tsunami of corporate bond supply arrives. We hope to pick up a relative bargain or two in credit in the thin August markets, but failing that we will have plenty of supply to choose from after Labor Day.

Discrete 12 month performance to last quarter end (%)**:

|

|

Jun-21 |

Jun-20 |

|

Liontrust GF Strategic Bond B5 Acc |

5.5 |

7.5 |

|

EAA Fund Global Flexible Bond - USD Hedged |

6.4 |

2.7 |

*Source Financial Express, as at 31.07.21, total return, B5 share class.

**Source Financial Express, as at 30.06.21, total return, B5 share class. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality, the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

Key Risks