The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income to investors above the FTSE All Share Index. Performance year-to-date has been satisfactory, delivering total return of 3.20% (C Acc share class, net of fees, GBP). This represents +160bps relative to our benchmark and places the Fund in the top quartile of the IA UK Equity Income comparator group.

The top contributor to performance so far has been 3i (+144bps), which we discuss in detail below, followed by Rentokil (+70bps), and Howden Joinery (+65bps). Rentokil, the world’s leader in pest control, has delivered typically reliable operating performance – cockroaches and termites care little for the macro economy – and management recently upgraded estimated synergies from its Terminix acquisition from $150m to over $200m. We initiated our position in Howden, the UK’s leading kitchen manufacturer, last autumn, during a market sell-off driven by concerns around inflation and the health of the UK consumer. We felt it was a ‘baby out with the bathwater’ and were able to buy what we consider to be a high quality business, offering both repeatable and growing cashflow, at a very attractive valuation. So far in 2023, we have been rewarded, with it delivering upgrades to consensus earnings expectations and seeing a re-rating of the shares on top.

The biggest detractors from performance have been miners Anglo American (-91bps) and Rio Tinto (-44bps), due to a mix of stock- specific (capex overruns at Anglo) and macro-related headwinds (caution on China Property and, as a result, iron ore prices). We recently added to positions in each with risk-reward, in our view, having become more favourable. We believe both occupy favourable positions on the commodity cost curve which will allow them to sustain a base level of cashflows and dividends across the cycle.

Dividend paying companies with Competitive Power: 3i

Year-to-date our holding in 3i has delivered a total return of 45.8% and made the biggest individual contribution to fund performance (+144bps). 3i is a listed private equity investment firm that owns a portfolio of high-quality growth businesses. It operates across several industries including retail, industrial technology, healthcare and business services, with the common thread that its holdings are aligned with structural growth trends.

3i’s largest investment is in discount retailer Action, which accounts for c.66% of its £16.8bn Net Asset Value (as at March 2023). We think it is a fantastic business. Action operates c.2,300 stores across 10 European countries, with its 11th (Portugal) set to open next year, generating revenues of c.€9bn. It sells a limited assortment of c.6,000 items in everyday categories such as food and drink; household goods; personal care; gardening; toys; and stationery. Over two thirds of the items it sells are priced at <€2 and c.90% at <€5. The business has delivered exceptional and consistent growth – over the past decade its store count has compounded by 21%; revenues by 25% and EBITDA by 28%, all on an organic basis. Having invested an initial £106m into Action in 2011, the carrying value to 3i of its c.53% stake has compounded to c.£11.2bn today, a remarkable journey of value creation.

Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to understand and identify quality. 3i and Action demonstrate all the building blocks of quality we look for across our portfolio holdings.

- It has a high return on invested capital (ROIC) of c.24% (post- tax), creating a self-funded growth-reinvestment flywheel.

- As dividend-focused investors, cashflow matters most and Action’s financial model is attractive, with the free cashflow conversion ratio (vs. net profit) typically exceeding 100%, boosted by a supplier-funded working capital structure.

- 3i’s Balance Sheet is robust, with its portfolio leveraged at c.2.5x (March 2023). This is considerably lower than most private equity funds, with debt also well-termed at average duration of >3 years and largely fixed rate in nature, providing both resilience and optionality.

- Action operates in attractive underlying markets – value for money and everyday essentials never go out of fashion, evidenced by Action having only one year of negative like-for-like (LFL) sales in the past 25 years (in 2020 due to the impact of the pandemic). Squeezed disposable incomes are driving consumers to seek better value and Euromonitor expects c.8% per annum mid-term growth for the discount retail industry. Indeed, management has identified significant white space store opportunity, potentially adding a further c.4,400 new stores to the estate over time (with cash payback on store capex of less than one year).

- Finally, we hold management in high regard. CEO Simon Borrows is an adept capital allocator, growing 3i’s NAV per share by c.18% (CAGR) since his 2011 appointment. And this is not simply an Action story – the rest of 3i’s portfolio has also compounded by c.10%. He is a top 10 shareholder and so has ‘skin in the game’, clearly thinking like a principal (i.e. owner) rather than an agent of shareholders’ funds. Illustrating this discipline, for several years 3i has deliberately undershot its target of £750m of annual capital deployment, reflecting increasingly frothy private market valuations.

It is difficult to find fault with 3i and Action’s track record. However, the future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to assess whether Action’s superior financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin the potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe Action has two of the seven Competitive Powers – Scale Economics and Counter Positioning – which, in combination, should underpin continued market share gains.

- Scale Economics: Action’s significant, multi-geography, revenue base is concentrated across a fairly narrow range of items, giving it huge buying power with suppliers. Additionally, the focus on price, quality and changing assortment (c.two thirds is flexible) results in a higher frequency of shop visits, customer retention rate and, ultimately, sales densities on a largely fixed cost base. Alongside a highly standardised and low-cost store operating model, low marketing expenditure and overheads, Action is typically able to undercut competitor baskets by c.30-40%.

- Counter Positioning: Action is able to enter markets and consistently take share from traditional ‘big box’ hypermarkets and category specialists, who seem unable or unwilling to respond. While this paralysis appears bizarre, it reflects Counter Positioning – the fact that mimicking Action’s business model would cause financial damage to an incumbent. Its competitors operate larger, higher-cost stores with sometimes >50,000 items and much more complex operating models. These features make it: i) difficult to copy Action’s lean model; ii) economically irrational, given Action’s (initial) small size, to price match and damage the existing profit pool. Time and again this delayed competitor response (the boiling frog metaphor applies) buys Action time to scale its business.

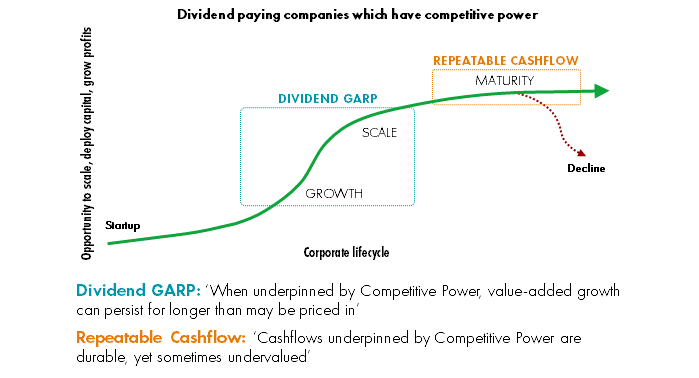

3i sits within the Dividend GARP portion of portfolio, formed of companies in the growth phase of the corporate S-Curve. Our investment hypothesis with this group of stocks is that ‘when underpinned by competitive power, value-added growth can persist for longer than may be priced in.’ They generally pay a dividend, though still with plenty of runway to reinvest their cashflows and grow their businesses, we expect returns to be driven by compound profit (and ultimately dividend) growth.

Notwithstanding 3i’s strong recent share price performance, we continue to see scope for attractive returns. 3i offers a prospective dividend yield of c.3.0% (FY24e) and we expect Action and other 3i portfolio holdings such as Cirtec (medical devices), Royal Sanders (health and beauty products) and SaniSure (bio-processing components) to underpin c.15-20% dividend CAGR over the medium term. The stock trades at a c.13% premium to its FY23a (March) NAV of £17.45/sh, not unreasonable for a company that has delivered an RoE of c.25% over the past five years and below the average of c.20% seen over the last 10 years. Within this Action is held at an 18.5x trailing 12-month EBITDA multiple. This translates to c.14-15x on a current year basis and compares to a peer group of discount retailers at c.13x, albeit with Action forecast to grow at almost twice the rate of growth of these peers. We also note 3i has historically valued its investments conservatively, with an average uplift vs. carrying value on portfolio disposals/exits over the 2013-22 timeframe of c.47% (source: Exane). We own a quality group of businesses at, we think, a reasonable price. Downside is protected by the strong, and economically countercyclical, operating performance of Action. Assuming the stock can hold its multiple (justifiably in our view), we see strong double-digit shareholder return potential as the NAV and dividend compound over time. Any re- rating to historical levels could accelerate returns.

Fund performance year-to-date has been satisfactory. We are, though, focused on the more substantial opportunity that exists to grow our investors’ wealth and dividend income over the long- term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.