The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. After a strong December we have had a tougher start to 2024 with the fund -212bps in January, underperforming the FTSE ASX by 73bps. Markets sold off after reappraising the pace of expected rate cuts by central banks this year and our fund is gently biased towards consumer and cyclical stocks, which suffered. This was compounded by a notable single stock detractor, discussed below.

The top contributor to performance in January was promotional products distributor 4Imprint (+63bps), which reported a re-acceleration in growth in the last quarter of the year. We profile this stock in more detail later in this newsletter. Other notable performers were at contrasting ends of the market cap spectrum, with pharmaceutical company GlaxoSmithKline (+33bps) and facilities management business Mears (+32bps) also contributing favourably on positive trading updates.

The worst performer in January was luxury watch retailer Watches of Switzerland Group (-91bps, WOSG). Its shares almost halved after a trading update delivering a major profit warning. This is embarrassing given we had profiled it as one of the stocks we were most excited about for this year. In investing positive outcomes can be the result of a good decision-making process, or a bad one that coincides with luck. Similarly, there are times when good decisions, combined with bad luck, can result in poor outcomes. This is an occasion where bad decisions resulted in bad outcomes; we got the outcome we deserved. In short, we became overly focused on the resilience of luxury watch demand and the status of WOSG's relationship with Rolex subsequent to its Bucherer acquisition. The mistake here, however, has come from a hyper-focus on market debates and therefore missing the true risk in the business. While this part of the business was fine, approximately 50% of WOSG's sales come from non-waitlisted watches and jewellery. These items are purchased by wealthy, but more economically sensitive consumers, come with higher contribution margin and saw a market slowdown through Christmas trading. WOSG had also been adding cost to its business as it rolls out new stores, compounding the sales miss. There were frailties in the business model that we had failed to appreciate. This is a painful mistake, but one we learn from, and at the end of January the fund’s exposure to WOSG was <0.5% of NAV.

Elsewhere, audio-visual distributor Midwich (-36bps) drifted lower despite a fairly robust trading update and multi-utility provider TelecomPlus (-28bps) was marked lower in the absence of any specific update, but likely as the market digested implications of a lower energy price cap on its profit growth (we expect this to be modest).

Dividend paying companies with Competitive Power: 4Imprint

4Imprint Group (FOUR) is a Top 10 position in the fund, representing c.3.6% of NAV. The company is the market leader (#1 share) in the sale and distribution of promotional branded goods in the U.S. It provides merchandise custom printed with the logo or name of an organisation, with the aim of promoting a brand, service or event. Categories range from inexpensive items such as pens, bags and drinkware to higher value items such as embroidered apparel, technology and full-size trade show displays. The business is headquartered in Oshkosh, Wisconsin.

We'll start with an overview of the business model. FOUR operates as an online marketplace, aggregating demand from a fragmented landscape of small-medium sized corporates (it processes c.2 million orders per annum) and routing this to its network of trusted supplier partners. To acquire customers, it runs a data-led marketing operation, focused on brand campaigns (TV and radio) alongside search engine optimisation. It operates a 'drop-ship' model and so holds very little inventory itself. Unlike, say, the Amazon marketplace (which has attempted to enter this market in the past with limited success), FOUR's model is 'high-touch' from a customer service perspective. Most orders will involve specific interaction between one of the company's c.1,500 customer service representatives around sampling, artwork, design and product characteristics. Pulling this together, FOUR provides a highly effective go-to-market solution for manufacturers who lack the scale, expertise or product breadth to run a direct-to-consumer model.

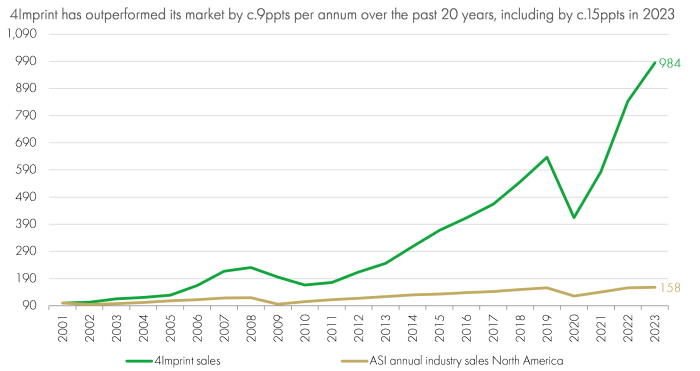

The quality of service has resonated with customers, with the company having delivered a revenue Compound Annual Growth Rate (CAGR) of c.15% over the past decade (2013-23a). All the more impressive is that this growth has been achieved entirely organically and is predominantly attributable to market share gains. To illustrate, for instance, industry trade body the Advertising Speciality Institute (ASI) reports a c.2% CAGR for the broader North American promotional products market. Market share gains are a good arbiter of a winning business model, in our view. This growth has translated into very strong returns for FOUR’S investors, with total shareholder return of >900% during that period, or an annual equivalent of >26%. Most recently, FOUR reported sales growth in 2023 of c.16% against an industry that was essentially flat.

Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to try and understand and identify quality. In our view, FOUR remains a competitively advantaged market share winner operating in a somewhat cyclical, but still fragmented and fundamentally attractive market. It demonstrates the five building blocks we look for across our portfolio holdings.

- Operating a capital light model in terms of both fixed assets and working capital, FOUR generates strong returns on invested capital (ROIC), achieving >150% in FY22a (post-tax). This has been supported by margins which have pleasingly trended higher over recent years (from c.6-7% EBIT five years ago to c.10% today), as its marketing spend efficiency has improved alongside growing brand awareness. These returns have created distributable cashflows for reinvestment into organic growth alongside shareholder dividends – FOUR has achieved a 5-year EPS CAGR of c.19% (2018a-23e) and 10-year of c.21% (2012-23e).

- As dividend-focused investors we want clean, cash generative financial models. FOUR reports clean accounts with no adjustments to earnings in recent years. Free cash flow to net profit conversion has averaged c.80% over the past three years, somewhat held back by expansionary capex investments and catch-up payments to address a legacy pension deficit (fully resolved from 2024e onwards).

- FOUR's Balance sheet is rock solid. As at end 2023 it reported net cash of $15 million with no debt. Its pension obligations have been de-risked by a recent 'buy-in' insurance policy and it has no material provisions booked.

- The promotional goods market might not screen as an ostensibly attractive underlying market – through the cycle growth is relatively low (c.2%) and demand is cyclical (the industry saw contractions of c.20% in both 2009 and 2022). Crucially, however, it is a fragmented market and one where 'best-in-class' operators can differentiate from the long-tail of subscale mom-and-pop type businesses. The Top 10 players in North America combined have only c.24% share and FOUR, as #1 player, has just over c.4%, implying a significant further runway for growth.

- We look for skilled, motivated management and can't imagine better stewards than CEO Kevin Lyons-Tarr and CFO David Seekings. Kevin has been with the business since 1991 and David since 1996 – a combined >60 years of service. They have consistently run the business for the long-term, fostering a unique culture, and retained a humble, prudent attitude despite their successes. Together they own c.1.6% of 4imprint and have shareholdings in excess of 3000% of salary. Kevin and David have never sought a long-term incentive scheme and have taken personal decisions to consistently decline significant market-matching salary increases such that their remuneration is well below similar sized companies. Judge people by their actions, so the saying goes.

The future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to get comfortable that FOUR's superior financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and, barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe FOUR has two of the seven Competitive Powers – Scale Economies and Network Effects, which can underpin its continued profitable growth.

- Scale Economies: As the fastest growing, biggest player in its market FOUR is able to get superior terms, including pricing and rebates, from its suppliers. Being a strategic partner also generally helps to ensure on-time, in-full deliveries to FOUR's customers. This combination ensures FOUR can offer both compelling price and excellent service to its customers. Another area where FOUR has been able to achieve scale economies is its marketing expenses. Over recent years it has pivoted away from traditional print media and towards national TV and radio brand campaigns. Smaller competitors simply couldn’t afford to do this. This has driven increased brand awareness and more direct traffic to FOUR's webstore. Marketing as a percentage of sales has declined from c.20% five years' ago to c.11% today, as efficiency from brand campaigns has been much higher than on the catalogues and free samples this spend has displaced.

- Network Effects: FOUR enables mutually beneficial transactions between suppliers and buyers to occur. For suppliers it aggregates demand and provides an efficient route to market; for buyers, it curates a comprehensive and competitive range. And once many buyers and sellers are using a marketplace such as FOUR's, it becomes harder for new entrants to lure them away. Buyers have access to a sufficient selection of products at attractive prices and sellers earn attractive profits, neither side has an incentive to go elsewhere, and network effects kick in: more buyers bring more sellers and vice versa.

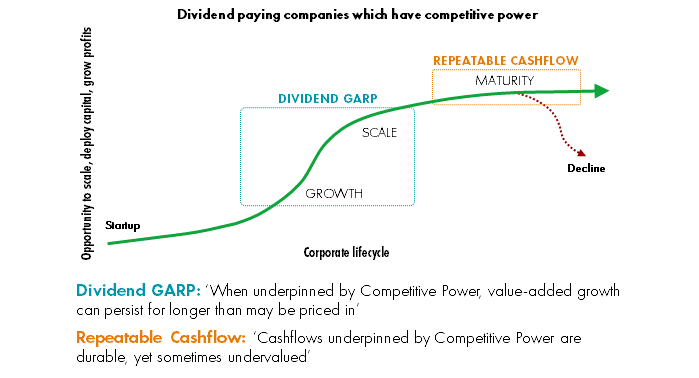

FOUR sits within the Dividend GARP portion of our portfolio, formed of companies in the growth phase of the corporate S-Curve. Our hypothesis with this group of stocks is that 'when underpinned by competitive power, value-added growth can persist for longer than may be priced in’. They generally pay a dividend, though still with plenty of runway to reinvest their cashflows and grow their businesses, and we expect returns to be driven primarily by compound profit (and ultimately dividend) growth.

Source: Liontrust

The stock offers a prospective dividend yield of c.3.0% (FY1-2e), which we expect to be supplemented by a special dividend at some point this year. We believe its Competitive Powers, aligned with attractive market structure, will allow FOUR to continue delivering double-digit growth in earnings, cashflow and dividends over the medium term. The stock trades on a blended forward P/E of c.17.1x (FY1-2e), towards the lower end of its 10-year range and has a prospective FCF yield of c.5.3%. While these are pricier multiples than the average in the fund, we think they are justified by the expected growth at high incremental returns on capital.

Fund performance over the past year has been slightly behind our benchmark. We remain focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.