- A good month for the fund (+109bps; +90bps vs. FTSE ASX)

- Idiosyncratic stock performance from Kitwave, Bank of Georgia and GlaxoSmithKline

- We profile Bank of Georgia, a gem of a bank, and explain our decision making process

The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. Performance improved in February with the fund +109bps, outperforming the FTSE ASX by 90bps. Markets remained choppy, with mixed signals around the inflation glide path and economic data remaining patchy. Performance was boosted by a handful of idiosyncratic single stock movements. Over one year the fund is in the 2nd quartile of IA UK Equity Income comparator group, a position replicated over three years.

The top contributor to performance in February was Bank of Georgia Group (+59bps), which benefited from ongoing strong performance from its core Georgian entity and the announcement of the accretive acquisition of Ameriabank, one of the leading banks in Armenia. We profile this stock in more detail later in this newsletter. Another notable performer was Kitwave (+41bps, profiled in our January newsletter), which reported strong results at the end of the month. At the other end of the market cap spectrum, pharmaceutical company GlaxoSmithKline (+33bps) again contributed favourably after upgrading its medium-term guidance alongside consensus-beating Q4 2023 results.

The key detractor in February was miner Rio Tinto (-30bps) which drifted lower, alongside its sector, as iron ore prices softened, despite reporting an 'in-line' FY23 set of results. UK supermarket Sainsbury's (-20bps), a relatively new position, sold-off following a Capital Markets Day in which it upgraded capex guidance to invest in EV charging points in its car parks and reallocation of floor space to more profitable food cabinets. Although impacting short-term free cash flow, we think these are good investments that will extend the duration of its current market leading sales growth. The grocery industry is one we have typically shied away from, due to its low returns on capital and lack of pricing power. However, recent changes in industry structure (both ASDA and Morrisons moving into levered private equity ownership) look to be creating a more benign competitive environment into which we see scope for Sainsbury's to positively surprise on margin growth. We have added to our position which now sits at c.2.5% of NAV.

Dividend paying companies with Competitive Power: Bank of Georgia

As mentioned earlier, Bank of Georgia Group (BoG) was the top contributor to performance in February, and at the close of the month our position was c.2.8% of NAV, having risen from a much lower weight at cost (c.2%). BoG has been held in the Income Fund since May 2023 and we have followed the company closely since late 2022. The business does what it says on the tin as the market leading lender in the Georgian economy operating across all segments of Retail (c.44% share of retail banking), SME, and Corporate & IB, but it also offers a financial ‘super app’ to consumers and has >55% market share in payment acquiring.

BoG boasts some of the most impressive operating metrics of any bank we’ve looked at as a team: in its Q3 2023 results BoG delivered loan growth of 19% while maintaining NIM >6.5% and strong cost control with a cost:income (C/I) ratio of <30%, seeing this translate to a return on equity (ROE) >30%. These are not one-time stand-out metrics – between 2018-22 ROE was >25% every year, with the exception of 2020 when the impact of Covid took it down to c.13%, while loan growth was >15% p.a (CAGR) for the period.

This performance is underpinned by a consolidated market (BoG and peer TBC are materially larger than the third largest player), a conservative regulator (BoG CET1 would be higher using the European standards), and what appears to be stable domestic monetary and fiscal policy (Georgian Lari has held its own vs sterling and the dollar while both political parties could be described as centre-right and pro-EU).

BoG has a digital-first approach as the largest technology employer in the country, facilitating the low cost to serve seen in the C/I ratio, but also delivering strong customer outcomes with NPS of >50 (context being that most UK traditional banks are around the zero level). Management has meaningful shareholdings in BoG and in February announced what appears to be a savvy piece of capital allocation – the intention to acquire the high-growth market leader in Armenia for <3x trailing earnings and delivering >20% earnings accretion in year one.

Overall, metrics like these could justify a valuation at multiples of book value given the value-creating growth on offer, and yet we were able to acquire our stake at a c.4x P/E multiple. When opportunities look too good to be true, it is important to ask why the opportunity exists. Often, stocks that appear very cheap may have any number of operational or financial challenges. In the case of BoG, the low multiple reflected: i) market perceptions of risk following Russia's invasion of Ukraine (Georgia borders Russia and the two countries fought a short war over the disputed South Ossetia region in 2008; ii) ‘orphan’ status of BoG as a bank which is UK-listed despite operating in a less well-known overseas country.

All this led some investors to simply 'not bother' with BoG lest the investment go wrong and save a potentially challenging conversation with fund holders. Our decision-making process acknowledged the risks, but also considered the implications of the Russia-Ukraine war to be more nuanced. For instance, a second order effect of the war was that Georgia was seeing significant net inward migration from young professionals emigrating from Russia and trade flows through its Black Sea ports and roads were also getting a meaningful boost. Counter-intuitively, we observed the company starting to deliver earnings upgrades.

Moreover, while the market was placing an ever-higher cost of equity on the stock, both Georgia and the EU were taking steps to accelerate its membership application. Its candidacy status was confirmed in December 2023. We thought this process could ultimately serve to lower the equity risk premium. While not naïve to the risks, we were buying a high quality, improving company that we thought could generate capital equivalent to its entire market cap in less than four years. We sized the position towards the lower end of our typical target weight to reflect the risk-reward profile.

While we cannot guarantee the shares continue to perform, we hope the message is clear that we are prepared to look for opportunities whether others may not want to, as this can lead to situations such as BoG where the true risks are more than adequately compensated.

To be clear though, we would not have considered investing in BoG had it not met the quality framework we apply as part of our process. Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to try and understand and identify quality. In our view BoG demonstrated the five building blocks we look for across our portfolio holdings.

1. i. Operating in a concentrated market and with digital investments driving a low cost to serve, BoG generates very strong returns on equity (ROE), achieving >25% FY18-23 (ex FY20 at c.13%). These returns have created distributable cashflows for reinvestment into organic growth alongside shareholder dividends – BoG has achieved a 5-year EPS CAGR of c.31% (2018a-23e, in GEL) and delivered 5-year trailing total shareholder returns of c.30% p.a (in GBP, assuming dividends reinvested).

2. As dividend-focused investors we want clean, cash generative financial models. BoG reports very clean accounts with immaterial divergence between reported and adjusted EPS over the past five years and the potential warning signs around credit quality haven’t been there with cost of risk covering loan losses.

3. BoG’s balance sheet is rock solid. It reported a CET1 of 18.7% vs. a regulatory requirement of 14.6% at 1H23a. We note stricter capital requirements from the Georgian regulator than applied to banks in Europe.

4. Georgia is a fundamentally attractive underlying market, a stark contrast to many other UK-listed banks given the more mature economy and higher levels of fragmentation. The market is a duopoly between BOG and TBC group, and so pricing of deposits and loan rates is rational and healthy. The economy is one of the fastest growing in Europe, with GDP at c.7% in 2023, providing ample opportunity for banks to grow their loan book. Both public and household debt sit at low levels compared to most developed European economies.

5. We look for skilled, motivated management and we have been impressed by our interactions with CEO Archil Gachechilaze and our most recent interaction with the chair of Ameriabank Andrew Mkrtchyan. The CEO has struck a balance in our meetings between ambition to pursue opportunities while retaining prudence against overextension – his holding of c.0.7% of the company and total compensation pay being >85% in shares no doubt help that alignment.

The future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to get comfortable BoG’s superior financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe BoG exhibits one of the seven Competitive Powers – Scale Economies – and is at least in the process of establishing another via Switching Costs, which can underpin its continued profitable growth.

- Scale Economies: Dominant market share gives BoG scale economies, allowing it to make significant capital investments in its digital and technology stack. This supports an excellent customer experience and allows it to capture adjacent profit opportunities (e.g. financial marketplace) at much lower cost than a new entrant would be able to.

- Switching Costs: BoG operates a financial ‘super app’ in Georgia, offering a full suite of consumer financial services from core banking to investment, an insurance marketplace, BNPL, and merchant partnerships. The app has 90% customer satisfaction scores as at Q3 2023 and a 4.8/5 App Store rating. It is deeply embedded in the lives of its users, with c.60% of the bankable population in Georgia using it. By helping its users save time and money, both procedural and financial switching costs are established.

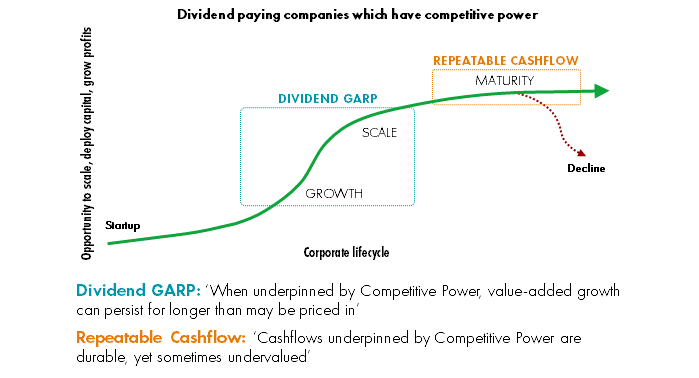

BoG sits within the Dividend GARP portion of portfolio, formed of companies in the growth phase of the corporate S-Curve. Our hypothesis with this group of stocks is that 'when underpinned by competitive power, value-added growth can persist for longer than may be priced in.' They generally pay a dividend, though still with plenty of runway to reinvest their cashflows and grow their businesses, we expect returns to be driven primarily by compound profit (and ultimately dividend) growth.

The stock offers a prospective dividend yield of c.6.5% (FY1-2e) on numbers updated for the proposed Ameriabank deal, which we think could be supplemented by ongoing share buybacks. We believe its Competitive Powers, aligned with attractive market structure, can allow BoG to continue delivering double-digit growth in earnings, cashflow and dividends over the medium term. We believe the shares are trading on c.4x PE once updated for Ameriabank, which is around the levels BoG has traded on since the Russian invasion of Ukraine and is well below the levels seen pre Covid (5-9x). Due to the low valuation, BoG is able to offer income comparable to stocks in our Repeatable Cashflow bucket, but with the growth ahead of many of our Dividend GARP stocks.

Fund performance over the past year has been satisfactory, in the context of subdued UK markets. We remain focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.