The Liontrust GF Global Dividend Fund continues to invest in innovative global leaders, buying companies on the right side of AI at cyclically depressed prices ahead of a new innovation cycle.

- March Top contributors: Constellation Energy, Broadcom, Intuit. Detractors: Thermo Fisher, Danaher, Alibaba

- A more constructive market backdrop is shifting focus back to company fundamentals

- Continue to remain active to capture dislocation opportunities

Performance overview

The Liontrust GF Global Dividend Fund returned 8.7% in May in US dollar terms, in-line with the return of 5.9% from the MSCI World Index comparator benchmark.

Fund commentary

Following months of extreme volatility, May proved much more positive for equities. Key was a de-escalation in trade tensions between the US and China, with Washington and Beijing agreeing to slash reciprocal tariff rates – from 145% to 30% and 125% to 10% for the US and China respectively for 90 days as talks continue. While talks are ongoing and trade relations remain dynamic, this removed – or at least significantly reduced – the single-biggest macro overhang.

This improved macro sentiment allowed investor focus to shift back to company fundamentals, with markets rallying throughout the month as companies continued to report throughout the Q1 earnings season. Indeed, the MSCI World Index rose nearly 6% (in dollar terms) in May, finishing the month up over 4% year-to-date – a swift recovery given the index was down 12% year-to-date in early April.

During sharp market sell‐offs or resets, the best‐performing stocks from the preceding period often suffer the steepest declines – a phenomenon we witnessed in recent months, with a number of innovative global leaders selling down sharply in March and April. However, as we have discussed in the past, the reason for these companies’ outperformance was because their fundamentals continued to run ahead of their share prices. This continues to be the case, now to an even wider degree as evidenced by persistently strong earnings updates. As such, we have remained highly active in the portfolio over the past few months, initiating or adding to positions in companies hardest hit to take advantage of this dislocation opportunity.

This approach was validated in May. With broader market sentiment improving, these same companies have been among the first to see their share prices recover, driving strong performance across the fund. For example, shares in Constellation Energy – the top contributor to performance for the month – finished May up 37%, having recovered nearly 80% from it’s early-April low. Similarly Broadcom, another top contributor, saw its shares rally 22% by month-end, up c.65% from its early-April low. Both company’s shares are up year-to-date.

While uncertainties remain over the ultimate path of trade policies, tariff-related inflation, and long-term treasury yields, we remain confident in the earnings power of our global leading innovators going forward – supported by secular growth dynamics, expanding moats, and improving fundamentals.

Strong fundamentals

The Q1 earnings season well underway, evidence of these improving fundamentals was on full display throughout May.

Constellation Energy provided another strong update during the month, delivering Q1 earnings per share (EPS) of $2.14, reaffirming full-year guidance of $8.90–$9.60, and reiterating its 13% target for average annual EPS growth through to 2030. We first invested in Constellation in early 2024 on the thesis that large-scale nuclear utilities would re-rate as demand for stable power generation becomes invaluable in the AI age. A year on, the opportunity looks even more compelling. Constellation owns the largest nuclear fleet in the US, 21 gigawatts (GW) across 23 reactors, roughly 2.5× the capacity of the next biggest operator, and supplying c.22% of all US nuclear power. That installed base is not only irreplaceable but increasingly sought after: hyperscale data centres are shifting from price to uptime, and clean baseload capacity is now mission-critical infrastructure. Upgrades are being driven by rising clean energy premiums, accelerating demand from AI workloads, and structural tailwinds from policy. The nuclear production tax credit provides downside protection and an inflation-linked floor, while the recently announced Calpine acquisition brings 26 GW of complementary natural gas assets with flexible load-balancing capability.

Critically, Constellation's AI strategy is not theoretical. The business is already signing large-scale, long-term contracts with data centre operators – notably including Microsoft, and more recently Meta – to provide clean, reliable power with fixed-price certainty over 20+ years. While volatility remains, due to long-dated cash flows and macro sentiment, the investment case is clear: Constellation is building the foundational grid layer for AI. In a world of constrained supply, regulatory bottlenecks, and rising demand, nuclear incumbency is a structural moat. This is no longer a defensive utility. It’s a next-generation compounder, well positioned to continue its strong double digit % earnings and dividend growth trajectory in the years ahead.

Eli Lilly also posted a strong update, with revenue up 45% and EPS up 29% year-on-year, both beating estimates. Management did, however, trim full year EPS guidance because of a one off charge related to the acquisition of an oral cancer programme from Scorpion Therapeutics. On the same day, CVS announced an exclusive agreement with competitor Novo Nordisk (also held). Neither development alters our investment thesis, so we took the opportunity to top-up our position after shares fell by over 10% post-update. Today, GLP-1 penetration in obesity stands at <1%, even though roughly two thirds of US adults are overweight or obese. The total addressable market for GLP-1s for weight loss is expected to approach US $100 billion by 2030. Over the past year Lilly has taken share and driven most of the category’s growth; losing a single distribution channel is therefore unlikely to dent momentum while the overall market is expanding so rapidly. In addition, Lilly’s direct self-pay vial strategy is gaining traction – already responsible for c25% of new US prescriptions – which sidesteps restrictive formularies and preserves margins.

Looking forward, we believe Lilly’s oral GLP 1 portfolio will be the real game changer. Orforglipron, the company’s once daily pill, delivered very positive Phase III data in type 2 diabetes, and a raft of late stage trials is under way across indications ranging from obesity to sleep apnoea. Pipeline catalysts are plentiful in 2025, and no competitor has yet matched Lilly’s weight loss efficacy in an oral format. Pills not only eliminate needle aversion; they are easier to manufacture and require no cold chain logistics, further lowering Lilly’s cost base. With improving fundamentals, structurally-underpinned earnings growth prospects, and a 5-year dividend growth CAGR of 15%, we continue to see Lilly as a truly innovative global healthcare leader, well positioned to drive strong returns ahead.

Elsewhere, Apollo Global Management posted an update which showcased the resilience of its business model. One of the highest quality compounders in the financials sector, Apollo has compounded shareholder returns 24% over the past 15 years, justifying a valuation premium which unfortunately meant it sat on our Global Innovators 200 watchlist for years given its expensive share price. That changed in March when market volatility created an attractive entry point, the stock down c.30% from its September high. However, the company’s May update demonstrated why scale, origination clout and a long‐term balance-sheet mindset still win in volatile credit markets. As one of the leading alternative asset managers, Apollo has pioneered the secular rise of private credit, which is emerging as a key funding source for long-duration assets like digital and energy infrastructure. In times of public market volatility private credit steps in – we saw this in the GFC, during Covid, during the 2022 US banking system volatility, and again now. This presents an opportunity for Apollo: as public market credit spreads widen, Apollo can deploy capital at these wider spreads, locking in better risk-adjusted returns for its investors. In April, for instance, Apollo invested $14 billion at spreads 50 basis points (bp) wider than those available in Q1, capitalising on dislocation.

What has been overlooked by the market in our opinion is the resilience of Apollo’s business model and its counter-cyclical features. Q1 saw Apollo delivering record fee earnings during market volatility (up 21% yoy, above expectations), 10% dividend growth, and $43 billion net inflows, demonstrating a business model that focused on long-term profit maximisation. Apollo was well-positioned for recent market turbulence with $64 billion in available liquidity, enabling the company to adeptly invest an enormous $25 billion in April as investment opportunities emerged -- the single largest active buyer of assets post Liberation Day. While macro may pressure some portion of spread-related-earnings in the near term, the ability to countercyclically deploy capital at scale will sow the future seeds of returns over the long term, underpinning its 5-year target of 10% annualised earnings and dividend growth.

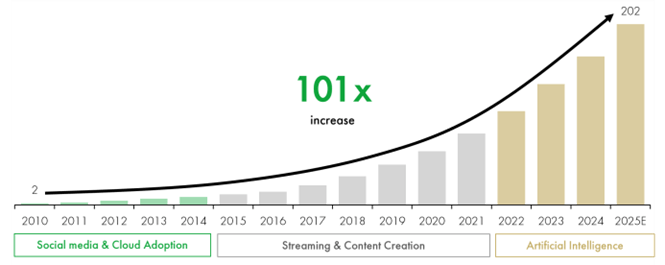

Massive capital demand: explosive data growth (ZB) underpins $15-20tn of digital infrastructure investment over the next decade

Sources: Blackstone, Apollo (2025)

We remain active

During periods of macro-driven volatility, we strategically increase our positions in the hardest-hit investments across the Fund. Accordingly, over the past couple of months we have been highly active in raising our positions in companies across various sectors where upside opportunity has best emerged. While markets generally improved in May, we continued to see pockets of opportunity to top up positions where share prices dislocated from underlying fundamentals, such as aforementioned Eli Lilly as well as Danaher – a key detractor to performance in the month, selling off on broader macro- and policy-related uncertainty. We remain confident in the company’s growth prospects, having just posted a constructive earnings update in April which highlighted an improving bioproduction backdrop, and as such topped up our position opportunistically.

We also topped up UnitedHealth – a position we had have been highly active in managing, substantially reducing our weighting in April ahead when the shares were up nearly 20% year-to-date. As we reported last month, the company subsequently posted a disappointing earnings update and guide – largely due to increased senior healthcare utilisation in the US – leading shares to fall by over 50% by mid-May. While the reset in expectations was disappointing, we maintain that the company’s long-term proposition remains intact, with the business model unchanged – as the largest health insurer in the US, UnitedHealth retains significant scale advantages and strategic differentiation through its vertically integrated model as payer, provider, and pharmacy benefit manager. As such, we saw this sell-off as significantly overdone, and opted to top-up our position mid-month; shares subsequently rallied by over 10% by month-end.

We also opted to re-initiate a position in Intuit – the global leader in consumer and small-business financial software, with a 15% five-year dividend CAGR. This proved astute, the company one of the top contributors to performance in May as shares jumped following a strong late-month beat-and-raise earnings update. Revenues rose 15% and EPS 18% year-on-year in Q1, driven by a particularly strong Consumer Group division where TurboTax Live saw a breakthrough 24% increase in customer adoption. With data from 100 million customers across its platform, Intuit is reaping the benefits of years of investment in AI and data management which it is using to improve internal operating efficiency, improving offerings for customers (tax filing times significantly reduced). This benefits the firm in a multitude of ways, such as freeing up advisor time to focus on customer onboarding, improving cross-selling opportunities, and reducing customer churn – lowering customer acquisition costs and improving cohort economics as management shifts focus to disrupting the advisor market. AI is also improving targeting, with Credit Karma revenues surging 31% year-on-year thanks to stronger credit-card and loan matching driven by the company’s AI-driven “Lightbox” engine. Elsewhere, the group’s global business solutions division continues to strengthen through accelerating product innovation – the company has seen an 8-fold increase in development velocity since 2020 – which is facilitating mid-market share gains as products such as such QuickBooks Online Advanced and Intuit Enterprise Suite resonate with customers (revenues up 40% year-on-year). As the company prepares to launch new AI agents for customer service, payments, project-management, and finance & accounting in the coming weeks, management is confident that Intuit remains well-placed to win in the era of AI-defined software which is driving enterprise software consolidation. This confidence is reflected in a raised full-year guide, management now expecting revenue growth of 15% and adjust EPS growth of 19%.

To finance these purchases, we reduced a number holdings of which have performed well, and exited certain companies whose upside potential is no longer sufficient. In May this included trimming recent strong performers such as Constellation Energy as well as the likes of Micron, Broadcom, and Nvidia – all companies we topped up on share price weakness in recent months, now trimming to reallocate capital to better upside opportunities as shares rallied by 20-40% through May. We also opted to exit our position in Antofagasta after it achieved our price target, as well as Thermo Fisher - one of the key detractors to performance in the month - as we saw better opportunities emerge on our watchlist. These companies move back to the watchlist where we will continue to monitor them for potential attractive entry points in the future.

Innovators remain well positioned for a new cycle

Supported by insights from recent team research trips to the US and Japan, we remain buoyed about the long-term growth prospects for innovative global leaders in the Fund, which remain well positioned for multiple new innovation waves across different sectors. This has been reinforced by another strong earnings season, where we have seen evidence of innovative companies proving their resilience and adaptability while strengthening their competitive positioning against a difficult market backdrop.

While a degree of macroeconomic and regulatory uncertainty persists, we are reassured to see that fundamentals – rather than sentiment – is starting to be rewarded in the market.

As always we will continue to maintain our valuation discipline, taking advantage of further market dislocations to invest in innovative companies at attractive prices.

Key Features of the Liontrust GF Global Dividend Fund

The Fund aims to achieve income with the potential for capital growth over the long-term (five years or more). The Fund aims to deliver a net target yield in excess of the net yield of the MSCI World Index each year.

There can be no guarantee that the Fund will achieve its investment objective.

The Investment Adviser will seek to achieve the investment objective of the Fund by investing at least 80% of the Fund’s Net Asset Value in shares of companies across the world. The Fund may also invest up to 20% of its Net Asset Value in other eligible asset classes. Other eligible asset classes include collective investment schemes (which may include funds managed by the Investment Adviser), cash or near cash, deposits and Money Market Instruments.

In addition the Fund may invest in exchange traded funds (“ETFs”) (which are classified as collective investment schemes) and other open-ended collective investment schemes. Investment in open-ended collective investment schemes will not exceed 10% of the Fund’s Net Asset Value. The Fund may invest in closed-ended funds domiciled in the United Kingdom and/or the EU that qualify as transferable securities. Investment in closed-ended funds will be used where the closed-ended fund aligns to the objectives and policies of the Fund. Investment in closed-ended funds will further be confined to schemes which are considered by the Investment Adviser to be liquid in nature and such an investment shall constitute an investment in a transferable security in accordance with the requirements of the Central Bank. Investment in closed-ended funds is not expected to comprise a significant portion of the Fund’s Net Asset Value and will not typically exceed 10% of the Fund’s Net Asset Value.

* As specified in the PRIIP KID of the fund.

6

** SRI = Summary Risk Indicator. Please refer to the PRIIP KID for further detail on how this is calculated.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- The Fund invests in global equities. The Fund may also invest in other eligible asset classes as detailed within the prospectus.

- The Fund considers environmental, social and governance (""ESG"") characteristics of companies.

- The Fund is categorised 6 primarily for its exposure to Global equities.The SRRI may not fully take into account the following risks:

– that a company may fail thus reducing its value within the Fund;

– overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund. - The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g.international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Liquidity Risk: the Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

- There may be times when those stocks that pay out higher levels of dividend underperform the market as a whole, or produce more volatile returns. The level of income is not guaranteed.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

A collective redress mechanism by consumers in respect of infringements of applicable Irish or EU laws is available under the Representative Actions for the Protection of the Collective Interests of Consumers Act 2023 which transposes Directive (EU) 2020/1828 into Irish law. Further information on this collective redress mechanism is available from Representative Actions Act - DETE (enterprise.gov.ie).