The two ranges of target risk funds (Blended and Dynamic Passive) that are designed to target the outcome expected by investors in terms of their level of risk, as measured by volatility, and maximise the return for each fund within the appropriate risk band while MA Explorer aims to maximise capital growth and/or income over the long term.

Liontrust works in partnership with advisers for the benefit of their clients.

Our Multi-Asset investment proposition and service is designed to enable advisers to provide the highest quality advice and service to their clients. We seek to help advisers achieve their clients’ investment objectives and meet their suitability requirements over the long term. We also help advisers to fulfil their responsibilities under Consumer Duty.

Liontrust achieves these aims through the following distinct partnership and service offering, which we call Actively Different.

Resources for advisers

Liontrust produces a range of reporting and literature for advisers, which can be white labelled or co-branded.

Resources for advisers' clients

Liontrust also produces a range of client facing literature.

Active management

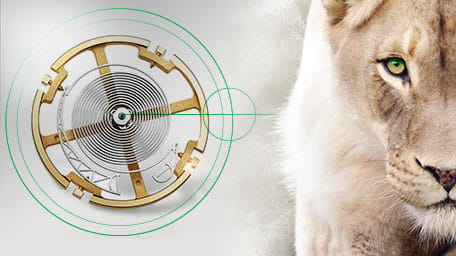

The Multi-Asset process is designed to target the outcome expected by investors in terms of their level of risk, as measured by volatility, and maximise the return for each fund and portfolio within the appropriate risk band.

There are five stages to the Liontrust Multi-Asset investment process:

- Bespoke Strategic Asset Allocation (SAA)

- Tactical Asset Allocation (TAA)

- Strategy selection

- Portfolio construction

- Monitoring, review and risk management

Every stage of this process is actively managed. For example, while the majority of the underlying vehicles within the Dynamic Passive funds and portfolios are passive, the decision as to which ones to include and in what proportions are still active decisions.

Active enhancements are made where we believe this will benefit the management of the funds and portfolios. We enhanced the SAA in 2023 to ensure we could meet the challenges and opportunities posed by our belief that investing over the next few years will be different from the last 15 years. We are facing an unprecedented political environment, including fragmentation of globalisation, which will impact economics and markets.

The Liontrust Multi-Asset team actively engages with the managers of the underlying holdings within their funds and portfolios.

The Multi-Asset investment beliefs

- Consistency of process

- Markets are not fully efficient

- Long term markets follow fundamentals

- Active asset allocation exploits short term mispricing

- Patience – time in the market, not timing the market

- Better to prepare for markets than react to them

- Multiple layers of diversification

- Governance, liquidity and risk management

Multi-Asset team and experience

The eight-strong investment team has extensive experience of Multi-Asset, equity and fixed income investing, with an average of more than 21 years in the industry.

Collectively, they have managed funds and portfolios for many decades through different economic and market cycles, and each member contributes to every stage of the investment process. The team was enhanced by the integration of the Liontrust Global Fixed Income (GFI) at the start of 2025 and benefits from being able to tap into the knowledge, insights and experience of the other investment teams at Liontrust, who primarily invest in equities.

The team is headed by John Husselbee, who joined Liontrust in 2013 and was previously a co-founder and CIO of North Investment Partners, Director of Multi-Manager Investments at Henderson Global Investors, and NM Rothschild & Sons.

Funds & portfolios managed by the team

Multi-Asset Funds

Multi-Asset Funds

MPS Portfolios

A broad range of 22 target risk model portfolios designed to meet most investors' risk and return objectives. They are designed for clients of financial advisers and are available on most major platforms.

MPS Portfolios

Global Fixed Income funds

The fund managers believe fixed income markets are inefficient and there are myriad ways of adding value to investors’ portfolios. The inefficiencies are caused by many market protagonists who are not price sensitive, ranging from the macroeconomic distortions caused by central banks to the idiosyncratic scenarios when companies need to raise debt finance and price accordingly.