The Liontrust GF Absolute Return Bond Fund (C5 share class) returned -2.0% in sterling terms in Q1 2022 and the IA Absolute Return, the Fund's reference sector, returned -0.1%. The Fund's primary US dollar share class (B5) returned -1.9%.

The Fund suffered from the joint headwind of much higher short-dated government bond yields and credit spreads widening during the quarter. Sovereign yields rising was the biggest driver for the Fund, closely followed by the impact of spreads. Yield carry and alpha combined to produce about 70 basis points of positive contribution, but this was not enough to mitigate such strong headwinds.

With such an enormous re-pricing of the short end of government bond markets, and a widening in credit spreads, our outlook for future returns for the Fund is very optimistic. In US Dollar terms, the Fund’s gross redemption yield (pre charges) is now above 3%; unless rate expectations re-price further still then the Fund should be able to get back to a positive total return for 2022 on yield carry alone; obviously we strive to add alpha as well.

Central bankers’ hawkish pivot

Putin’s illegal and immoral war on Ukraine has obviously been the largest driver of risk sentiment for financial markets in 2022. The humanitarian impact on the Ukrainian population should not be understated but from the perspective of global bond markets, we do need to examine the economic contagion from the war.

The most obvious contagion is via higher energy prices. These are effectively a tax on consumers and there will be a wallet substitution effect as people spend more on energy costs. The impact will vary across Europe depending on the energy mix in the economy and the amount of government subsidies. Provided that Russian energy keeps flowing to Europe, then the impact of higher energy prices should be to trim growth forecasts; post pandemic excess savings can absorb the extra costs, albeit this mitigating factor is not evenly distributed. Across in the US there will be far less of an impact due to energy self-sufficiency and the offsetting effect of higher shale gas activity when energy prices are high. Clearly the global “peace dividend” that most countries have benefitted from in the last few decades has been consigned to history for the foreseeable future. Defence spending commitments have been increased, most notably in Germany. As Putin’s forces failed to have the swift military victory he expected, the focus of bond markets turned back to the inflationary problem.

In 2021 there was a huge debate in financial markets about inflation; those that sided with the high and sticky inflation camp proving to be correct. US consumer price inflation is presently 7.9%; last time we had 7% inflation, interest rates in the US were at 13%! Eurozone inflation is currently 7.5%, with the peak still to come as higher energy prices feed through. But the inflation debate is a 2021 story; the bond market’s focus in the first quarter of 2022 has been about how G7 central bankers have reacted to stop higher inflation becoming a self-fulfilling prophecy.

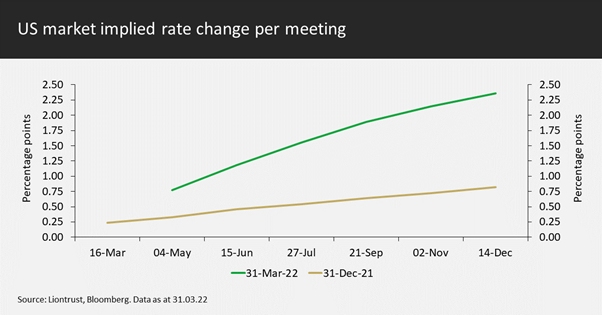

The Federal Reserve’s response has been to end quantitative easing in March and raise rates by 25 basis points. Quantitative tightening, the shrinking of the Fed’s balance sheet, is anticipated imminently with an announcement likely at the Fed’s May meeting. Examining rate expectations in the US, it is clear from the chart below that market expectations have shifted a long way in the first quarter of this year. Implied rates now show that the market anticipates the equivalent of eight more rate rises at the remaining six Fed meetings in 2022 –so at least two hikes of 50 basis points rather than the standard 25 basis points increment. Rates are now expected to rapidly reach their neutral level in the US. We estimate this level to be in the 2.0% to 2.5% range with the Fed’s median estimate residing at 2.4%. Then in 2023 monetary policy is forecast to get tight. The ramifications of this for the economy and bond valuations are covered later in this commentary.

During February, the ECB finally came to the realisation that they need to do something about inflation. As the last of the major central banks to proverbially raise the monetary policy anchor, this had huge ramifications for bond yields. The pivot from ECB members has been to say that they expect QE (quantitative easing) to finish this year. Rate rises are now a distinct possibility. Indeed, the market at the end of March is pricing in over five rate rises (10bps a time) before the end of 2022.

So why has the ECB, as well as previously dovish members of the Fed, pivoted towards tightening policy sooner? The answer, in my opinion, is the risk they see of inflation becoming embedded in economies. The manifestation of this is in corporate and consumer expectations. When higher inflation levels become entrenched in the mindset of economic agents, they alter their behaviour accordingly. The most important factor is wage inflation – with tight labour markets and pressures on the cost of living, it is completely rational that there is upward pressure on wages. Once the circularity of higher inflation and wages gets started, it can lead to a sustained period of core inflation exceeding central bankers’ targets. Headline inflation will start falling later in the year, but if central bankers have said they are focusing mainly on core inflation whilst headline was so high, they cannot simply switch their methodology once headline inflation starts falling.

US yield curve flashing a warning signal

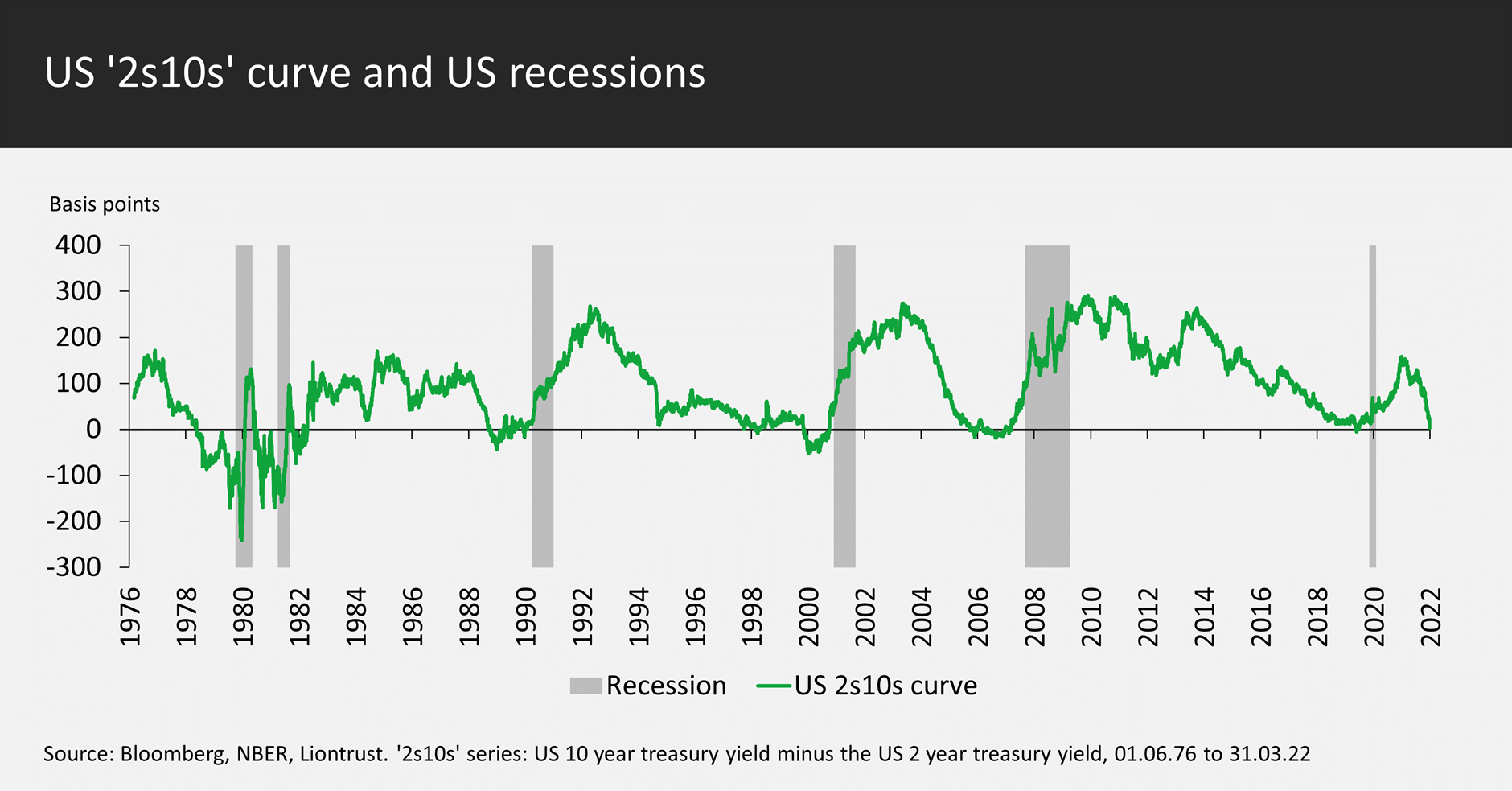

Every US recession in the last 50 years has been preceded by an inversion of the US yield curve. This much-followed market indicator has infamously predicted nine of the last six recessions, but even with the false positives it is a phenomenon that cannot be ignored. In March, the Federal Reserve raised interest rates for the first time since 2018; by the end of the month, the curve had briefly inverted intra-day.

Firstly, for those not familiar with bond market jargon, the yield curve merely represents the difference in yields between bonds of varying maturities. Normally, yield curves are upward sloping; it is riskier to lend to the government for longer periods as the chance of inflation eroding the value of your bond investment goes up, as does the risk of a deterioration in the credit quality, or even of a default. The specific part of the yield curve studied as a recessionary indicator is the US 2s10s: the difference in yields between the US 10-year government bond and 2-year Treasuries. An inversion is when the latter yields more than the former.

I should note that others prefer to look at 3-month yields compared to the 10-year. The two generate similar results but the 2s10s is more forward looking. On average, it takes about 18 months after the 2s10s yield curve inverts before a recession starts, but there is a large variation around the timing. There is less of a lag between any inversion of the 3-month versus 10-year yield differential and a recession occurring – this just shows that policy had become too tight (interest rates are too high and have choked off growth and investment). Presently, the curve between 3 months and 2 years in the US is very steep; effectively telling you that the Federal Reserve is hugely behind in this cycle and will be increasing interest rates rapidly to try to catch up.

During March, various Federal Reserve speakers voiced opinion that the pace of tightening must accelerate, with the consensus now saying that interest rate policy has to get beyond neutral or even to tight levels in order to bring inflation under control. Explicitly, the Fed’s median dot plot policy rates predictor is now 2.8% versus its estimate of a 2.4% neutral level (we discussed the hawkish rate rise during March). The problem is that inflation has become embedded in expectations, with wage inflation being the most important self-fulfilling inflationary feedback loop.

The Fed has its own preferred measure (the 18-months forward 3-month rate minus the current 3-month rate), but all it currently shows is that the Fed should not have left policy so loose for so long – we have been vocal in that regard since early 2020. More interestingly, officials were keen to talk about the prospect for an economic soft landing, such as that achieved in 1994. The bond market clearly disagrees, as you can see from the narrowing of the spread between 10-year and 2-year yields in the chart above (a flattening of the yield curve), before the yield curve’s brief intra-day inversion). So, is it “different this time?”

There is an argument that quantitative easing (QE) has depressed the term premium, the extra yield one should be paid for owning longer maturity government bonds. I have some sympathy with this but would counter that QE has also kept short rates too low. Whilst the yield curve would probably be steeper without QE, the flattening of the last 3 months cannot be ignored. This is particularly the case as we rapidly approach the period when quantitative tightening (QT) will start.

Although interest rates were much higher half a century ago, there is strong similarity with the experience in the 1970s in that the curve currently is inverting as we witness a supply shock. Firstly, the pandemic constrained supply and, post the great economic reopening, there are still bottlenecks throughout the supply chain including, for example, for semiconductors. Now Putin’s war has caused further spikes in commodity prices. These will continue to feed into headline inflation over the months to come. But will they feed into core inflation in the longer term? For this we need to look at the demand side of the equation.

The consumer is in a fortunate position of having a strong balance sheet, with excess savings having accrued during the pandemic lockdown periods. These savings are not distributed equally, with socio-economic groupings A to C owning the vast majority. Thus, it is the lower socio-economic groups that not only lack savings but also have a higher exposure to headline inflation through the necessity of heating and eating; such basics are frequently excluded from core inflation calculations. The wallet substitution impact of higher energy prices can be mitigated in two ways, government intervention (with huge variance country by country) or by wage inflation. Labour markets are tight and elevated wage inflation remains our central case for the next couple of years – hence why central bankers are having to act.

For some time, we have believed that economies are comfortably strong enough to live with interest rates being higher for longer, especially if they curb inflation and actually improve living standards. This is on the basis that, for example, the Federal Reserve raises rates to the 2% area and keeps them there, rather than raise more aggressively only to cut in short order. With some Fed voting members now wanting rates above 3%, the goalposts have shifted and there is a real danger rates are now raised to recession-inducing levels.

So, to answer whether it will be different this time: if the Fed rapidly raises interest rates to be above 3%, then we think a recession is likely to follow in 12-24 months’ time (so, no, it is not different this time); if, however the Fed is partly just talking a hawkish game to discourage inflation expectations and pauses at 2%, then we will expect a soft landing and the yield curve to start steepening again.

Carry Component

We split the Fund into the Carry Component and three Alpha Sources for clarity in reporting, but it is worth emphasising we manage the Fund’s positioning and risk in its entirety. As a reminder, the Carry Component invests in investment grade bonds with <5 years to maturity; within this there is a strong preference for investing in the more defensive sectors of the economy.

With frequent tenders and maturities within the Carry Component there is a constant need for new purchases. Added to this, we increased the weighting within the Fund to closer to 65% during the quarter. Bonds bought were from issuers including AT&T, Mondelez, Baxter International, Daimler Trucks, UniCredit, HSBC and Dell.

Alpha Sources

Rates

The short end of the US Treasury market is now discounting a rapid tightening cycle. 5-year US Treasury yields have effectively doubled in the first quarter from approximately 1.25% at the end of 2021 to just below 2.50% at the end of March. The improved valuations have led us to reduce the Fund’s duration underweight, moving from 1 year to 1.25 years compared to a neutral level of 1.5 years. All of the Fund’s duration emanates from the US Treasury market; the duration contribution of euro-denominated credit is being hedged out using German government bond futures.

Profits were taken on the long position in 5-year Swiss government bonds relative to the 5-year German BOBL future. This has been a mean-reverting relationship which has helped to generate incremental performance for the Fund on numerous occasions. We also closed out the long France relative to Germany, using 1-year bond futures, as buying credit was deemed a better use of risk budget.

Allocation

Credit spreads widened during the quarter, driven by both Putin’s war and the fears over the removal of central banking support for the bond market. With the ECB owning €328 billion under its CSPP (Corporate Sector Purchase Programme) it was unsurprising to see euro-denominated credit spreads widen more than their US cousins.

We took the opportunity to increase the Carry weighting in the Fund from 63% at the start of the year to 77% at the end of the quarter. For most of 2021 the weighting was around 55%, near the bottom of the Fund’s 50-95% permitted range for Carry. This is all part of managing the Fund’s market beta and risk through the cycle, albeit both will always be low due to the nature of the Fund.

Valuation discrepancies between European and US credit default swap (CDS) indices did not reach attractive enough levels for any cross market CDS position to be established.

Selection

Names added to Carry during the quarter included Coca-Cola, Societe Generale, Magallanes (the AT&T Time Warner/Direct TV spinout), Moody’s and Verizon.

There were no outliers when it came to credit performance – the contribution of any position was highly correlated to its historical beta. Laggards included The Southern Company, Pershing Square, Eli Lilly and Aroundtown. Given we have no fundamental credit concerns on any of these companies, we would expect their bonds’ credit spreads to start tightening in again as the market’s geopolitical fears recede.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns

|

Mar-22 |

Mar-21 |

Mar-20 |

|

|

Liontrust GF Absolute Return Bond C5 Acc GBP |

-1.9% |

6.4% |

-2.5% |

|

IA Targeted Absolute Return |

2.5% |

10.1% |

-3.3% |

Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

*Source: Financial Express, as at 31.12.21, total return (net of fees and interest reinvested), C5 class.

**Source Financial Express, as at 31.12.21, total return, C5 class. Discrete data is not available for ten full 12-month periods due to the launch date of the portfolio

Key Features of the Liontrust GF Absolute Return Bond Fund

|

Investment objective & policy1 |

The investment objective of the Fund is to generate positive absolute returns over a rolling 12 month period, irrespective of market conditions. There is no guarantee the investment objective will be achieved over this or any other time period. The Fund aims to achieve its investment objective through investment in corporate and government fixed income markets worldwide, including developed and emerging markets. In achieving its objective, the Fund also aims to minimise volatility and reduce the possibility of a significant drawdown (i.e. a period where the Fund is worth less than the initial investment at the start of a 12 month period). The Fund invests in a wide range of bonds issued by companies and governments, from investment grade through to high yield. The Fund invests in developed and emerging markets, with a maximum of 20% of its net assets invested in emerging markets. Investments are made in US Dollar denominated assets or non-US Dollar denominated assets that are predominately hedged back into US Dollar. Up to 10% of the Fund's currency exposure may not be hedged (i.e. the Fund may be exposed to the risks of investing in another currency for up to 10% of its assets). The Fund may invest both directly, and through the use of derivatives. The use of derivatives may generate market leverage (i.e. where the Fund takes market exposure in excess of the value of its assets). The Fund has both Hedged and Unhedged share classes available. The Hedged share classes use forward foreign exchange contracts to protect returns in the base currency of the Fund. The fund manager considers environmental, social and governance ("ESG") characteristics of issuers when selecting investments for the Fund. |

|

Recommended investment horizon |

5 years or more |

|

Risk profile (SRRI)2 |

2 |

|

Active/passive investment style |

Active |

|

Benchmark |

The Fund is actively managed without reference to any benchmark meaning that the Investment Adviser has full discretion over the composition of the Fund's portfolio, subject to the stated investment objectives and policies. |

|

Sustainability profile |

The Fund is a financial product subject to Article 8 of the Sustainable Finance Disclosure Regulation (SFDR). |

Notes: 1. As specified in the KIID of the fund; 2. SRRI = Synthetic Risk and Reward Indicator. Please refer to the KIID for further detail on how this is calculated.

Fund positioning data sources: UBS Delta, Liontrust.

† Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF Absolute Return Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.