While 2020 was a year that no one will forget, mainly for the wrong reasons, there is cause for optimism in 2021. Liontrust fund managers highlight investment ideas that give them reasons to be cheerful for the year ahead.

Samantha Gleave, Cashflow Solution Team

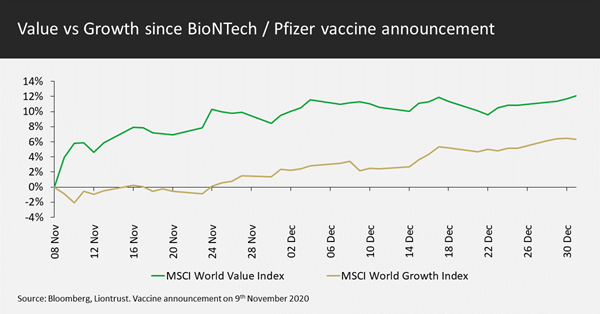

The development of potentially effective and safe Covid-19 vaccines has given the world hope that an end to this pandemic is in sight. For stockmarkets, this has given impetus to value stocks, which for a number of years have underperformed their growth counterparts. The promise of a return to normality has seen value stocks rally, having been shunned through the crisis. A new US administration has further underpinned the value opportunity, with the potential for a significant infrastructure stimulus programme to be announced.

Our cash flow analysis suggests the potential for significant further upside in value in 2021. By our measures, there is a wide spread in share valuations between value companies, which tend to have high cash flow yields because their share prices have been depressed, and growth companies, where share prices are elevated but cash flow yields are low.

The near-term economic outlook remains very uncertain, which will undoubtedly contribute to bumps in the road for this economically sensitive investment style. However, recent developments – medical, political and economic – should not be ignored. Has a new value-led market regime finally started to emerge?

Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise.

Victoria Stevens, Economic Advantage Team

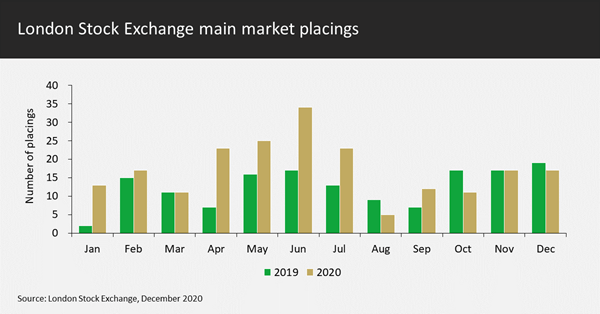

The Covid-19 crisis led to some companies needing to raise funds quickly to tackle the short-term cash crunch from restricted trading conditions. However, it also displayed just how resilient and adaptable listed businesses can be; many companies were able to take a front-foot approach to tackling the rapidly changing economic backdrop, raising funds for proactive reasons such as making acquisitions or otherwise accelerate growth against a very dynamic business backdrop.

In this respect, the pandemic also highlighted the substantial benefits of being listed on the stockmarket, which provides an efficient and relatively immediate source of capital. London Stock Exchange data showed there were 208 Main Market share placings in 2020, comfortably exceeding 2019’s total of 150. Unsurprisingly, these fundraisings peaked in the second quarter as companies reacted to the new trading conditions in which they found themselves.

Pleasingly for us, the majority of stocks in the Economic Advantage funds have proven resilient to the pandemic, and those raising fresh capital have largely done so for proactive reasons. We look forward to monitoring their progress in 2021 and stand ready to support our companies in their growth plans when required.

Peter Michaelis, Sustainable Investment Team

Pharmaceutical companies are clearly at the centre of public attention at present, with news on vaccines encouraging markets and the global population to look forward to a better 2021.

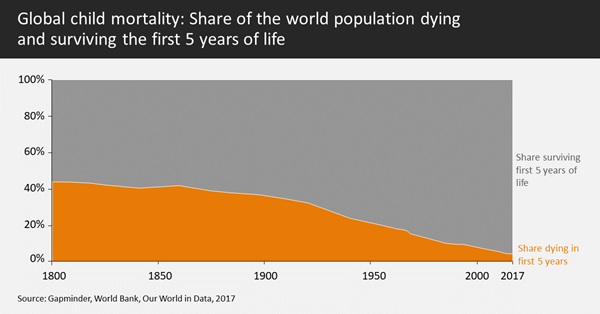

Beyond the urgent efforts against Covid-19, ongoing improvement in healthcare is vital for a more sustainable future, and the sector’s ability to innovate in order to solve medical needs is what attracts us as investors. We continue to see huge advances in technology across areas such as gene editing and DNA sequencing and these are revolutionising how we think about the concept of treatment. The traditional model has a large element of trial and error, with people seeking help when they feel ill and hoping whatever drug or procedure prescribed is effective – but this intervention often proves too late. In contrast, we are moving towards a more personalised system where we can understand how someone’s genetics make them vulnerable to certain diseases, and this is opening up new ways to counter conditions such as cancer, dementia and Parkinson’s.

Healthcare innovation has had a massive impact on people’s lives and will continue to do so: a child born at the start of the 20th century had a one in three chance of not reaching their fifth birthday, whereas that figure has thankfully now improved to one in 25 globally (and one in 250 across most of Europe). It is exciting to consider what further advances the coming decades may bring.

Phil Milburn, Global Fixed Income Team

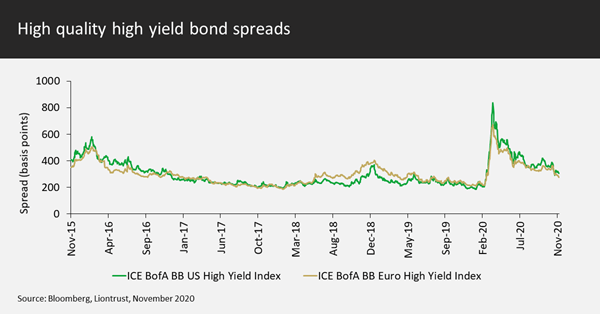

The anticipated economic recovery in 2021 will provide a strong tailwind for most companies’ revenue and profits. The myriad companies that issue high yield bonds to help finance their business are no exception; their outlooks have improved considerably after the fantastic news about vaccines. Forecasts for default rates within high yield were already falling before the vaccine news and now following it, we believe they are set to come down rapidly. And remember that defaults have tended to be concentrated in troubled sectors, such as leisure, retail and energy, as well as lower rated high yield bonds.

The highest quality high yield bonds attract a BB rating and are only one rung below investment grade on the credit ratings scale. The credit risk within these types of bonds is already low, and with good stock picking can be reduced further. Credit spreads, the extra yield the corporate bond has compared to government debt, have rallied but still offer great long-term value. At approximately 3% in both the US and Europe, there is a decent premium – about 1% more than the lows we have seen in the last 5 years.

We believe that BB rated bonds are currently the sweet spot within credit – the Liontrust High Yield Bond Fund has a 45% weighting to them. In this world of ultra-low interest rates, investing in bonds with a contractually guaranteed coupon from high quality names such Netflix, Allfunds and Charter Communications is a prudent way of generating income in 2021.

Robin Geffen

Technology will again be a critical feature in stock markets in 2021. Those companies that fail to use technology could become casualties and those that benefit from incorporating technology may become stock market heroes.

In the UK, the high street has seen a substantial casualty recently in the form of Arcadia, with brands like Top Shop, Dorothy Perkins and Burton. The company’s failure to develop online led to ASOS and Boohoo taking market share.

The FAAMGs (Facebook, Apple, Amazon, Microsoft and Google) have performed very strongly in 2020 and look well set for 2021. Microsoft and Apple pay good and fast-growing dividends and in time we believe the others will pay dividends as they mature. Not all technology companies’ shares have performed well at the same time, however. It is interesting to note that, while many technology companies' shares saw profit-taking after the positive vaccine news, both Visa and Mastercard rose on investors' expectations that holiday, hotel and airfare spending could return to normal.

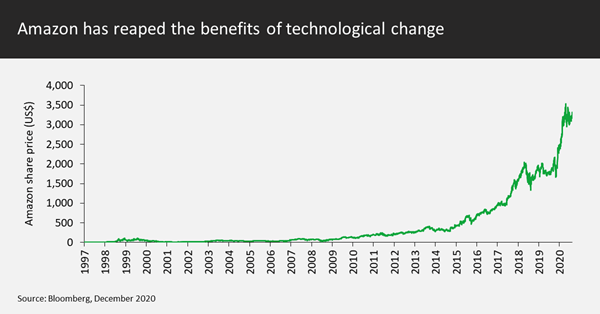

2021 offers great opportunities in technology whether you are looking for mature companies, such as Apple, Microsoft, Visa and Mastercard to provide reliable, growing dividends; mid cap technology stocks growing far faster than the market like Twilio, whose share price rose 244% in 2020 (three years ago its share price was US$25 against US$350 at the end of last year); or small caps to find the next FAAMGs. On 16 May 1997, you could have bought Amazon shares for US$1.73, while today they trade at over US$3,100, an extraordinary rise of nearly 180,000%. Around 320 Amazon shares would make you a dollar millionaire today at a cost of just US$554 in 1997. The next FAAMGS are out there just waiting to be found.

Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise.

Storm Uru, Global Innovation Team

Many of us were in a hurry to turn the page on 2020 and the prospects for 2021 are bright – a vaccine, the ability to see friends and family again, maybe even a little travel. But for some companies who have been riding the wave of technological change, have leadership positions and have focused on innovation, 2020 presented a once-in-a-lifetime position to outcompete undercapitalised, unprepared rivals.

Even before this year, the past decade has witnessed a doubling in the rate of innovation – 300,000 US patents per year versus 150,000 per year in 2000s. Look no further for evidence of what we have witnessed this year – a complete bifurcation between those that have innovated and those that have not – than comparing Amazon with H&M.

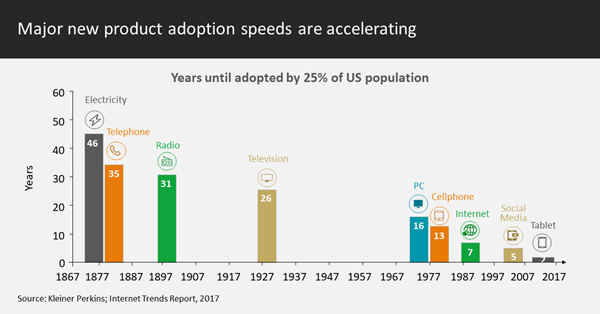

This is not a new trend, as technology adoption speeds have been accelerating for decades. Those companies which have harnessed technological change to drive lower prices or higher quality products for customers are well positioned to drive shareholder returns over the next five years.

2020 was unlike any other year, and those companies that benefited from the demand-side shift now have an unprecedented opportunity to convert this leadership position and become the next Alphabet or Microsoft. These are companies which are part of our everyday life and provide services we rely on.

Innovation is one of the most important drivers of shareholder wealth creation and this year it has become the most important, offering companies that were prepared an opportunity like no other.

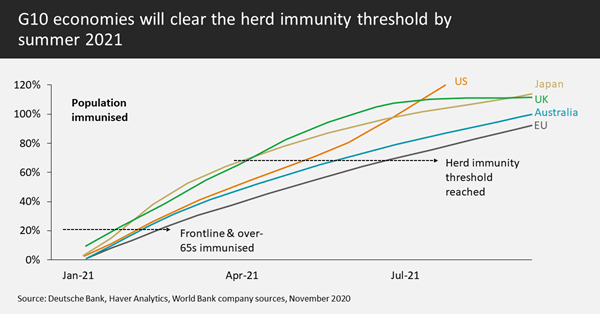

Positive news on Covid-19 vaccine development is a clear reason to be cheerful, with mankind’s ingenuity on show to crack the virus code in a matter of months rather than decades. The chart shows the huge number of people set to be immunised and efficacy has become the new word of the day, with everyone hoping they can return to some kind of normality in 2021. Recent events have also allowed investors to recalibrate their expectations for companies, a vaccine ‘floor’ if you will, creating more certainty around valuations. This has prompted broader stockmarket performance in terms of geography and style, expanding leadership beyond the US technology names that have dominated.

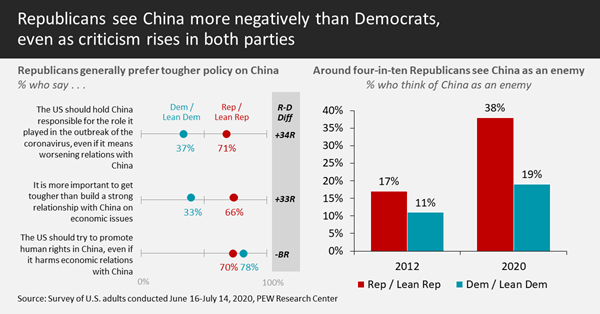

Joe Biden’s victory in the US presidential election suggests a return to more centrist politics and policies after a period of more populist extremes, whether from right or left. A calmer approach to international relations should mean some normalisation of geopolitical risk and the global trade outlook, and reduce one recent source of volatility in risk assets, with Asia/emerging markets and export-driven sectors set to benefit.

For a comprehensive list of common financial words and terms, see our glossary here

Key Risks

Please remember that past performance is not a guide to future performance and the value of an investment and any income generated from it can fall as well as rise and is not guaranteed, therefore you may not get back the amount originally invested and potentially risk total loss of capital.

This content should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust.