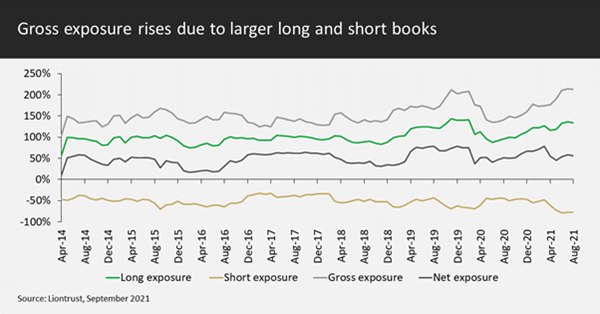

We have pushed the Liontrust GF European Strategic Equity Fund’s gross exposure to its highest level since the Fund took on its variable long/short investment strategy in 2014. This increase in gross market exposure is a direct reflection of the compelling investment opportunity we see in markets currently. Due to unprecedented levels of value dislocation in equity markets, this opportunity is equally attractive for both the long and short books.

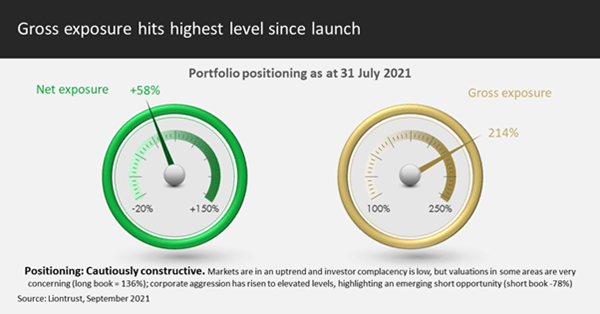

The net market exposure is around 58% of the Fund net asset value (NAV), a fairly typical level for the Fund which reflects a cautiously constructive overall outlook we have for equities. But the gross book has hit 214% of NAV, comprising 136% long book positions and 78% short exposure.

This gross book size is a record for the Fund and we would expect such a large level to be a relatively infrequent occurrence in the future. It results from a very particular set of market circumstances: a large dispersion of share price valuations across the stockmarket which means we find large numbers of stocks we think are undervalued but also lots that we believe are too expensive.

If there was less valuation dispersion in markets, we’d likely be more unambiguously bullish or bearish, which would manifest itself in a lower gross book.

If we were bearish on markets, we would have a large exposure on the short side but a small long book, resulting in a low (or negative) net market exposure and lower gross exposure. If we were more bullish, we’d have a large long book and high net market exposure but few positions in the short book, meaning – again – a relatively low gross exposure.

The chart shows the Fund’s positioning on four investment exposures since launch: long, short, net and gross. We can see that the upswing in gross exposure (grey) to above 200% from below 150% in the summer months was driven by a rise in the long exposure (green) and expansion in the short book (gold).

In the long book, one of the value dislocations we are looking to exploit is that which exists between growth and value stocks. The former typically trades on very high levels whilst the latter remains historically depressed despite some signs of better relative returns in late-2020/early-2021. After a decade of underperformance culminating in a capitulation during the initial Covid-19 market sell-off in early 2020, we think value stocks are primed for returns.

We explained recently that the increase in our short book was motivated by pockets of the market where aggressive corporate investment is worryingly high but share valuations are exorbitant.

With markets drifting steadily higher in recent months, the larger short book has been a headwind to Fund performance in absolute terms, but year to date our short positions have handily underperformed the market. At the same time, our long holdings have outperformed the market.

We are pleased there are early indications momentum is travelling in our direction, but the value dislocations are so great we believe there is significant performance potential in the current portfolio.

The value dislocations we observe today are by far the most extreme we have seen in our dataset which stretches back to the 1980s. Never have the valuations of unattractive stocks on our Cashflow Solution process – companies with poor cash flow control that are expensive and suffering poor business momentum – looked as expensive as they are today when compared to stocks the process finds attractive.

We know from our own empirical work across markets all over the world that the single most powerful forward predictor of factor performance is whether a factor is cheap or expensive relative to history. This suggests that there is now significant potential for the short book of the Fund to perform well in future months.

For a comprehensive list of common financial words and terms, see our glossary here.

Key Risks

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. Investment in Funds managed by the Cashflow Solution team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The Liontrust European Growth Fund holds a concentrated portfolio of stocks, if the price of one of these stocks should move significantly, this may have a notable effect on the value of the respective portfolio. The Liontrust Global Income Fund's expenses are charged to capital. This has the effect of increasing dividends while constraining capital appreciation.

Disclaimer

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.

KEY RISKS

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. The majority of the Liontrust Sustainable Future Funds have holdings which are denominated in currencies other than Sterling and may be affected by movements in exchange rates. Some of these funds invest in emerging markets which may involve a higher element of risk due to less well-regulated markets and political and economic instability. Consequently the value of an investment may rise or fall in line with the exchange rates. Liontrust UK Ethical Fund, Liontrust SF European Growth Fund and Liontrust SF UK Growth Fund invest geographically in a narrow range and has a concentrated portfolio of securities, there is an increased risk of volatility which may result in frequent rises and falls in the Fund’s share price. Liontrust SF Managed Fund, Liontrust SF Corporate Bond Fund, Liontrust SF Cautious Managed Fund, Liontrust SF Defensive Managed Fund and Liontrust Monthly Income Bond Fund invest in bonds and other fixed-interest securities - fluctuations in interest rates are likely to affect the value of these financial instruments. If long-term interest rates rise, the value of your shares is likely to fall. If you need to access your money quickly it is possible that, in difficult market conditions, it could be hard to sell holdings in corporate bond funds. This is because there is low trading activity in the markets for many of the bonds held by these funds. Mentioned above five funds can also invest in derivatives. Derivatives are used to protect against currencies, credit and interests rates move or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions.

DISCLAIMER

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.